Welcome to Musings on Market — your daily dose of business insights, trends, and updates that matter. In this space, we go beyond the headlines to explore the evolving world of companies and industries. Each day, we bring you thoughtfully curated insights, sharp observations, and key developments shaping the business landscape.

Whether it's a strategic pivot by a market leader or an under-the-radar company making waves, we break it down for you — clearly, concisely, and consistently.

In Today’s edition we cover the following topics:

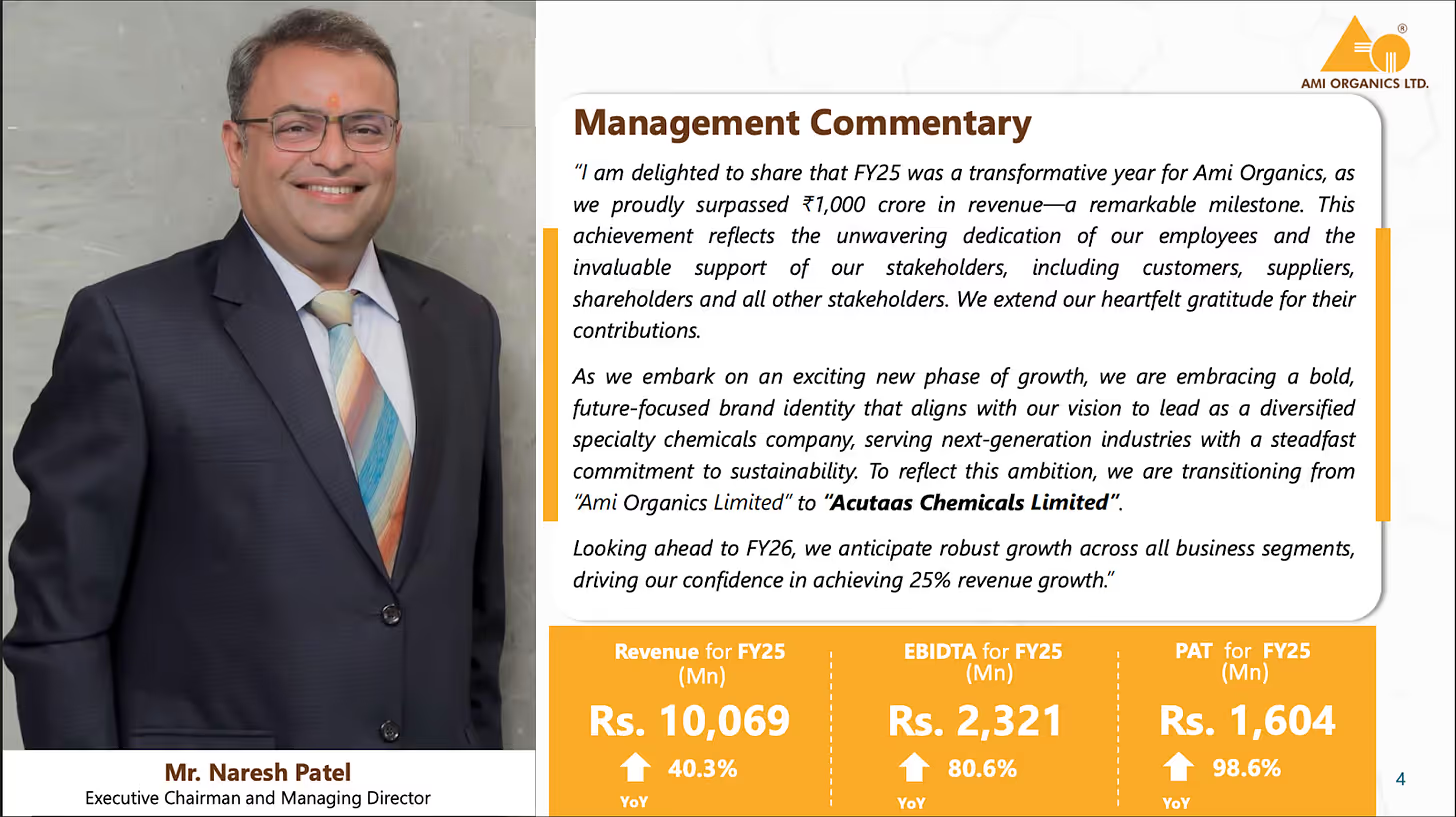

Ami Organics (AOL), a rapidly expanding manufacturer of pharmaceutical intermediates and specialty chemicals, is poised to maintain its high-growth trajectory. This momentum is fueled by its pharma CDMO operations and increasing contributions from emerging sectors, notably electrolyte additives and semiconductor chemicals.

AOL's most significant immediate growth catalyst is its CDMO agreement with Fermion. This contract involves supplying chemical intermediates for darolutamide, a rapidly expanding, patent-protected drug used in the treatment of prostate cancer.

AMI organic’s pharma CDMO revenue is projected to increase significantly from Rs2.75 bn in FY25 to Rs10 bn in FY28 and Rs16 bn in FY30, driven by darolutamide intermediates contract revenues reaching Rs7 bn by FY28 and Rs10 bn by FY30 (as per company guidance).

IEX reported strong monthly results for April 2025, with a 26% year-over-year increase in postings. Peak demand reached 235 GW, exceeding the April 2024 high of 224 GW. Despite this surge in power demand, the average Day Ahead Market clearing price remained competitive at Rs. 5.20/unit in April 2025, consistent with the previous year, due to increased supply.

FY26 Peak Demand can further increase to 270 GW because of the rising power demand. Also in response to the above increasing demand, the government implemented several measures such as mandatory operations of coal-based, gas-based, and better availability of coal to meet the increased demand.

Godrej Properties (GPL) wrapped up FY2025 with a blockbuster performance, delivering its highest-ever quarterly pre-sales of ₹101.6 billion in Q4—up 7% YoY—on the back of 12 new launches including major projects like Riverine in Noida and Astra in Gurgaon. This drove full-year pre-sales to ₹294 billion, up 31% YoY, beating its own guidance of ₹270 billion.

Collections were equally robust, with Q4 collections jumping 43% YoY to ₹76.4 billion, boosting operating cash flows and helping reduce net debt to ₹32.7 billion. FY25 revenues surged 62% to ₹49.2 billion, while PAT more than doubled to ₹15 billion, reflecting strong execution and improved financial discipline.

Despite a modest EBITDA margin of 5.2% in Q4, the company saw a turnaround at the operating level for the year. GPL’s delivery momentum remained strong at 18.4 million sq. ft in FY25—up 47% YoY—but is expected to moderate to 10 million sq. ft in FY26 as the company shifts focus toward consolidating gains.

Looking ahead, management has guided for 10% pre-sales growth in FY26 to ₹320 billion, supported by new launches worth ₹400 billion. Collections are projected to rise 23% to ₹210 billion, while land acquisition activity will continue at a healthy pace with a business development target of ₹200 billion.

In summary, FY2025 marked a milestone year for GPL with record-breaking sales, strong cash flows, and prudent debt management, setting a solid foundation for its next phase of sustainable growth.

Momentum in the Hotel sector and even in the largest player continues well as the company reports strong growth in Q4FY25 performance -

Indian Hotels Company Ltd (IHCL) capped Q4 FY25 with its strongest-ever quarterly performance, demonstrating both top‑line momentum and margin expansion. Consolidated revenue rose 27% YoY to ₹2,487 Cr, while EBITDA jumped 30% to ₹918 Cr, lifting the EBITDA margin to 36.9%. In the Hotels segment, revenue grew 13% to ₹2,206 Cr with EBITDA up 20% at ₹848 Cr, translating into a robust 38.5% margin and a 30.2% PBT margin in Q4 FY25 .

For the full year FY25, IHCL delivered record results across the board: consolidated operating revenue surged 23% to ₹8,565 Cr, with EBITDA up 28% at ₹3,000 Cr and a 35.0% margin. Excluding a one‑off exceptional gain of ₹305 Cr, PAT climbed to ₹1,603 Cr—an expansion of over 4.5x since FY17. The Hotels segment mirrored this strength, delivering ₹7,841 Cr in revenue (+13%), ₹2,815 Cr EBITDA (+20%) and a 35.9% margin, alongside a 27% jump in PBT to ₹2,118 Cr .

Operationally, IHCL’s like‑for‑like RevPAR grew 16% YoY in Q4, with occupancy at 80%, underpinning a full‑year RevPAR premium of 73% versus the industry. This outperformance reflects consistent double‑digit growth across key markets and segments .

Underpinning these results is a bold growth strategy: 74 new signings and 26 openings in FY25 have expanded IHCL’s footprint to 381 hotels (46.5 k rooms). IHCL also strengthened its balance sheet, swinging net cash to +₹2,850 Cr and generating free cash flow of ₹1,099 Cr, while RoCE improved to 17.3%, setting the stage for sustained value creation in FY26 and beyond

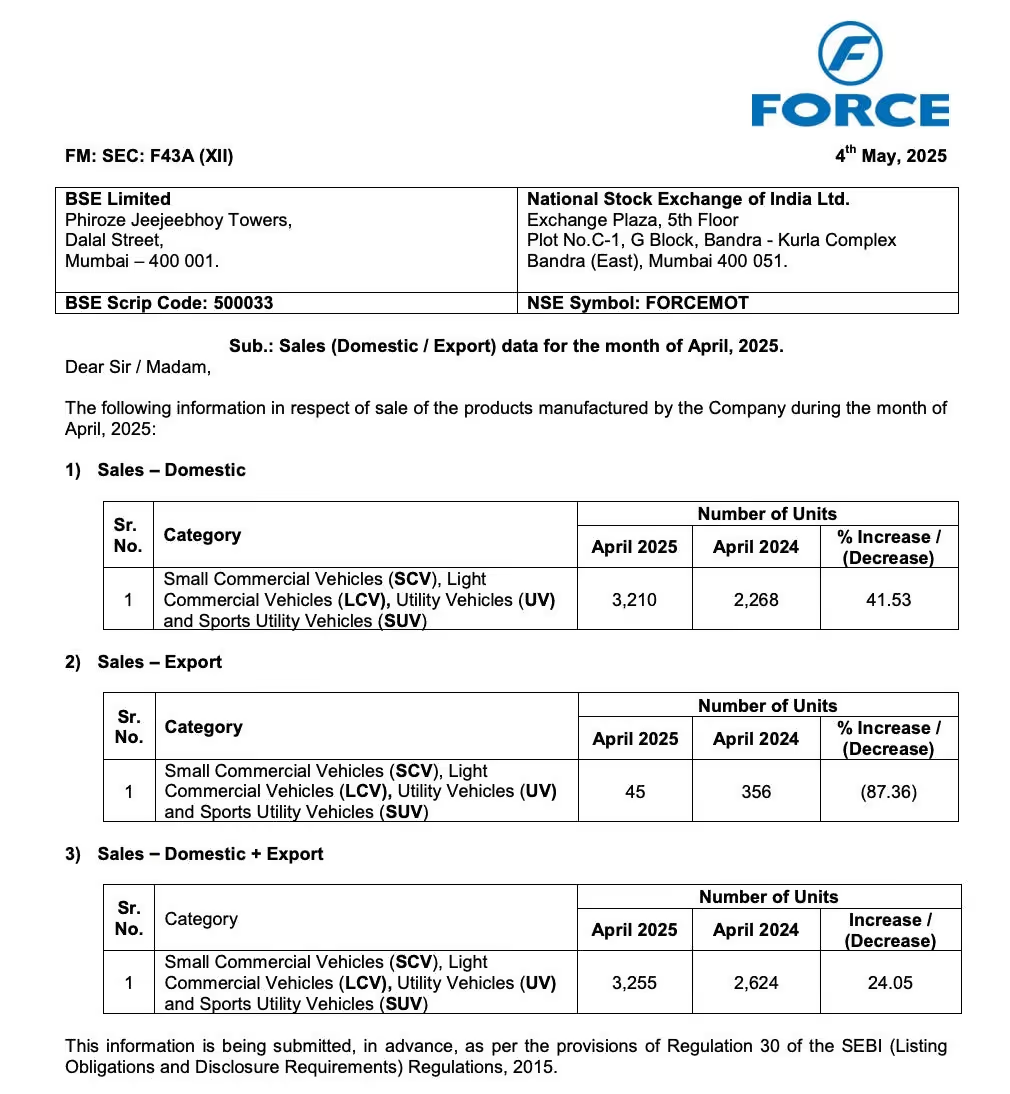

Sales Performance (April 2025)Sales Performance (April 2025)

Segment-wise Performance

Recent Strategic & Product Developments

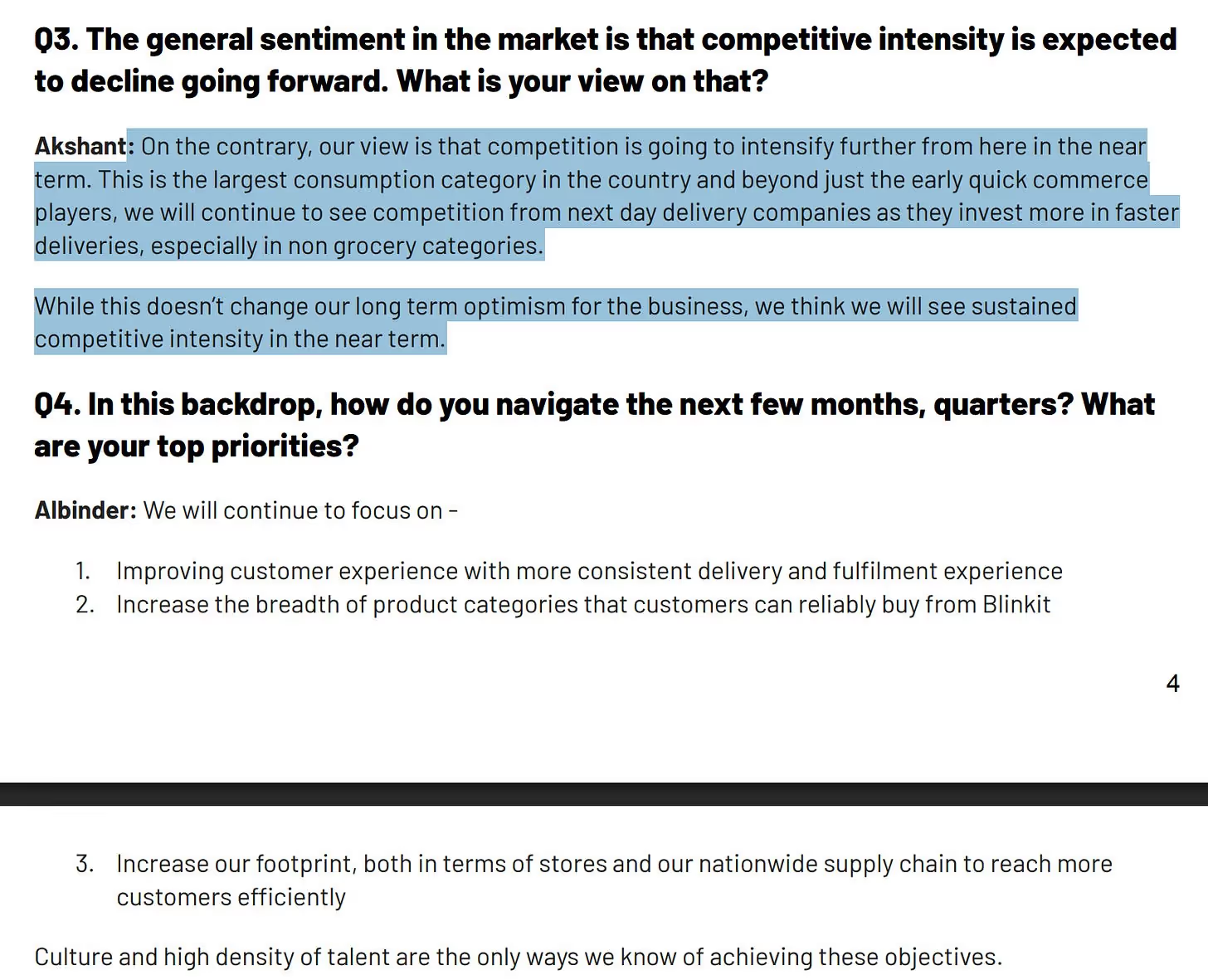

Eternal's Q4 FY25 results show a 60% YoY revenue growth to INR 6,188 crores, with a 15% YoY EBITDA decline, partially due to investments in quick commerce. On top of the increased competition in quick commerce there was a demand slowdown in the food delivery business showing GOV growth of only 16%YoY.

Q4 FY25 highlights (quarter ended March 31, 2025)

Full-year FY25 highlights (year ended March 31, 2025)

Margin pressure vs. rising competition

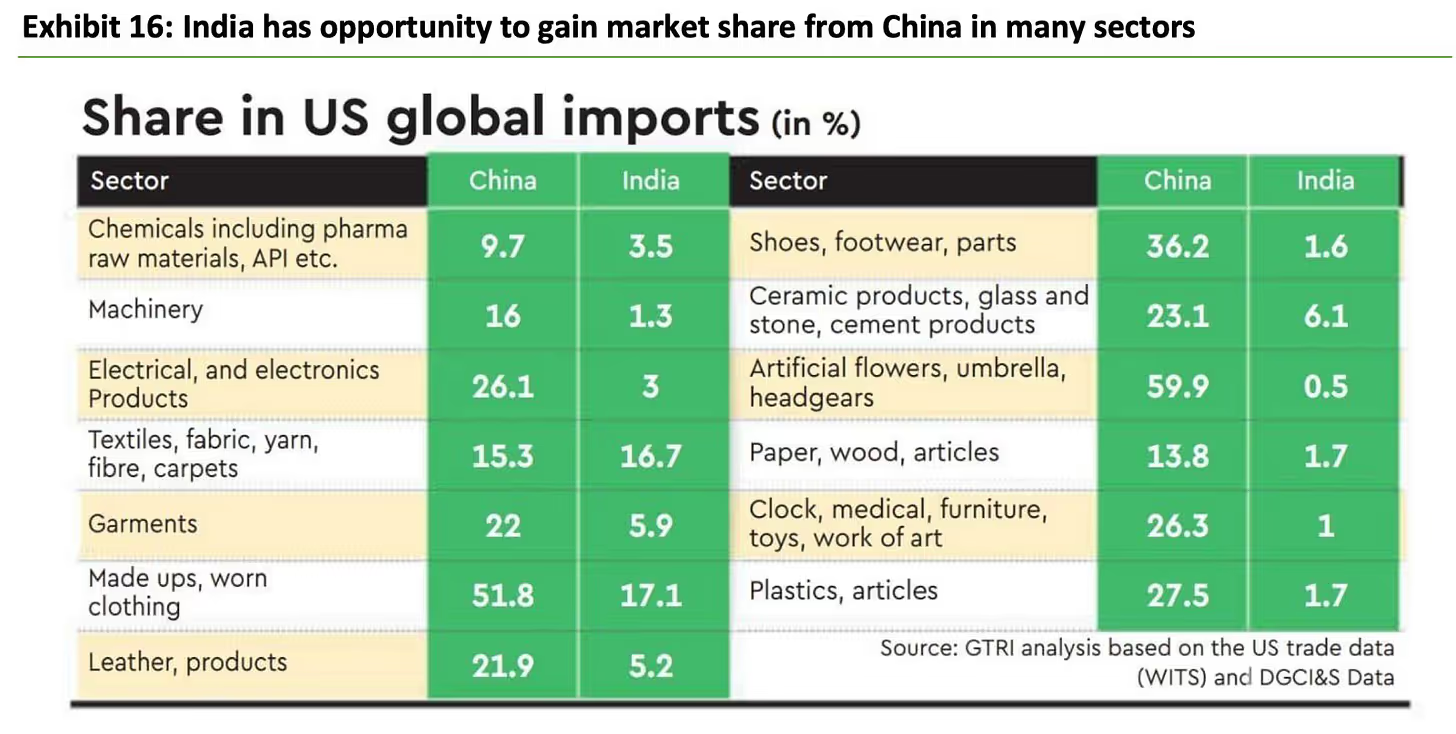

Since 2018, the U.S. has slapped 25 percent “Section 301” duties on hundreds of billions of dollars’ worth of Chinese exports, and Beijing has retaliated in kind. The tit-for-tat has disrupted long-standing supply chains and sent American importers scrambling for new sources. Europe, too, has flirted with carbon-border adjustments and slapped tariffs on aluminum and steel. Meanwhile, India itself has raised duties in certain sectors to protect nascent domestic champions.

All this protectionism is, paradoxically, a lifeline to exporters in countries that still enjoy relatively open access—India among them. As purchasing managers in the U.S. face steep duties on Chinese electrical-and-electronics (26.1 percent of their imports) or ceramic-and-glassware (23.1 percent), they’re actively seeking alternative origins. India, which currently accounts for just 3 percent of U.S. electronics and 6.1 percent of ceramics, is ideally placed to pick up the slack—provided it can scale capacity fast enough and streamline its own tariff and logistics hurdles.

The only category where India already out-paces China is textiles, fabrics & yarn—a testament to long-standing strengths in cotton, silk and related value chains. But look at garments, leather goods and pharma inputs, and you see potential for rapid market share gains if Indian producers can match the scale, quality and delivery reliability of their Chinese competitors.

In a world where nearly every major economy is deploying tariffs as geopolitical tools, India stands at a crossroads. Will it seize the “decoupling dividend” and transform these pockets of opportunity into enduring competitive strength? Or will it let red tape, infrastructure gaps and its own protectionist reflexes rob it of the chance to become the next global manufacturing powerhouse? The answer will shape not just India’s trade statistics, but the broader architecture of post-China supply chains in the decade to come.

Today's market musings painted a vibrant picture of dynamic change and robust growth across multiple sectors. From Ami Organics' surge fueled by CDMO agreements and IEX's burgeoning power demand to Godrej Properties' record-breaking pre-sales and Indian Hotels' stellar performance, we see clear signs of momentum. Force Motors' domestic sales surge and Zomato's competitive struggles further illustrate the evolving market landscape. Additionally, the shift in Indian US import data highlights a significant opportunity for India as global trade realigns. As we navigate this complex environment, adaptability, strategic foresight, and continuous innovation will be key to capitalizing on the emerging trends. Stay tuned for more insightful updates as we continue to explore the pulse of the market!

The information provided in this reference is for educational purposes only and should not be considered investment advice or a recommendation. As an educational organization, our objective is to provide general knowledge and understanding of investment concepts. We are SEBI-registered research analysts.

It is recommended that you conduct your own research and analysis before making any investment decisions. We believe that investment decisions should be based on personal conviction and not borrowed from external sources. Therefore, we do not assume any liability or responsibility for any investment decisions made based on the information provided in this reference.

0 Comments