%2016_9%20(1).png)

The third quarter of 2025 has unequivocally established Artificial Intelligence as the primary engine of growth and strategic investment across the technology sector. The earnings reports from Alphabet, Amazon, Meta, Microsoft, and Teradyne reveal a seismic shift, characterized by record-breaking revenues, staggering capital expenditure commitments, and a unified focus on building out planetary-scale AI infrastructure.

This period marks the full-blown arrival of an "AI arms race," where dominance is measured in compute capacity, talent density, and the successful integration of AI into every facet of business and consumer life.

Let’s dive deeper with this Investor’s edge analysing Q3 of AI Boom →

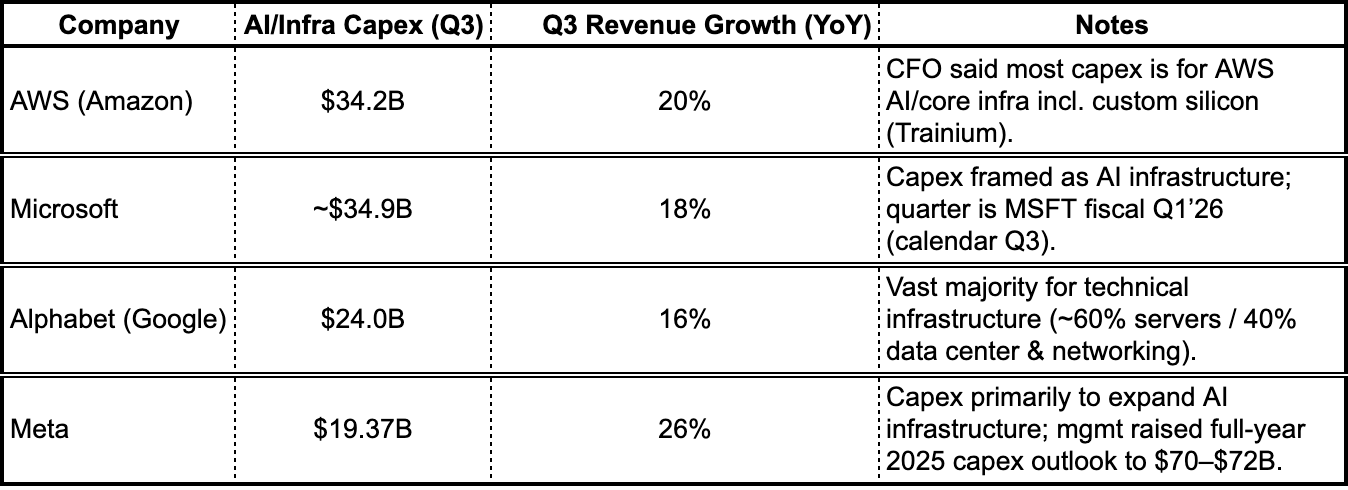

Every major technology firm is aggressively front-loading capital expenditures to build out AI capacity.

Microsoft plans to double its data center footprint in two years and expects FY26 CapEx growth to be higher than FY25.

“Capital expenditures were $34.9 billion, driven by growing demand for our Cloud and AI offerings. This quarter, roughly half of our spend was on short-lived assets, primarily GPUs and CPUs, to support increasing Azure platform demand, growing first-party apps at AI solutions, accelerating R&D by our product teams as well as continued replacement for end-of-life server and networking equipment. The remaining spend was for long-lived assets that will support monetization for the next 15 years and beyond, including $11.1 billion of finance leases that are primarily for large data center sites.”

Meta anticipates "notably larger" CapEx dollar growth and "significantly faster" expense growth in 2026.

“As we make significant investments in infrastructure to support this work, we are focused on preserving maximum long-term flexibility to ensure we can meet our future capacity needs while also being able to respond to how the market develops in the years ahead. We're doing so in several ways, including staging data center sites so we can spring up capacity quickly in future years as we need it as well as establishing strategic partnerships that give us option value for future compute needs. We expect full year 2025 total expenses to be in the range of $116 billion to $118 billion, updated from our prior outlook of $114 billion to $118 billion and reflecting a growth rate of 22% to 24% year-over-year. We currently expect 2025 capital expenditures, including principal payments on finance leases to be in the range of $70 billion to $72 billion, increased from our prior outlook of $66 billion to $72 billion.”

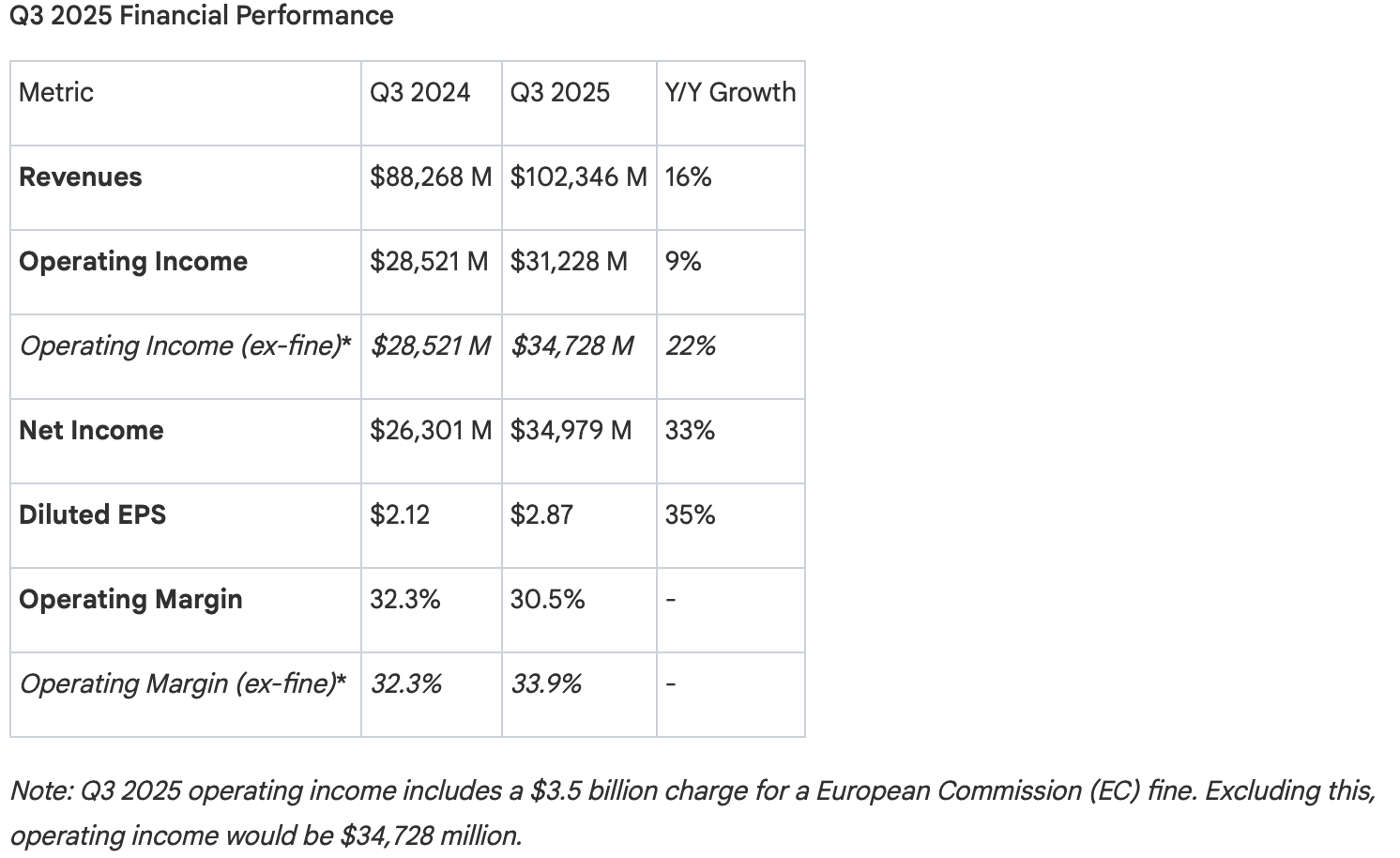

Alphabet's CapEx has surged 83% year-over-year to nearly $24 billion for the quarter.

“With respect to CapEx, in the third quarter, our CapEx was $24 billion. The vast majority of our CapEx was invested in technical infrastructure with approximately 60% of that investment in servers and 40% in data centers and networking equipment.”

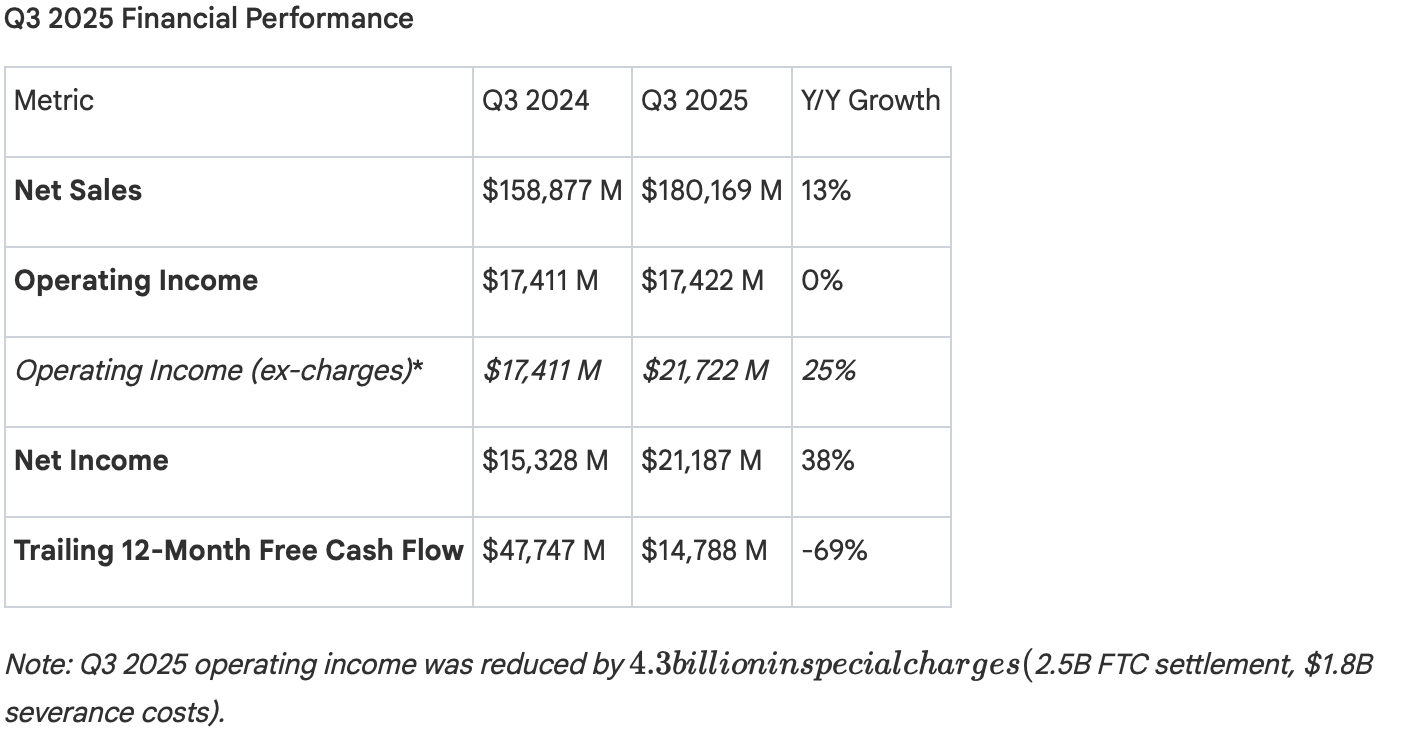

Amazon is adding over 1 gigawatt of power capacity in Q4 alone and will double its 2022 power capacity by 2027. This spending is a direct response to insatiable demand and the strategic imperative to lead in frontier model development.

“To put that into perspective, we're now double the power capacity that AWS was in 2022, and we're on track to double again by 2027. In the last quarter of this year alone, we expect to add at least another 1 gigawatt of power. This capacity consists of power, data center and chips, primarily our custom silicon, Tranium and NVIDIA. We've recently brought Project Rainier online, our massive AI compute cluster spanning multiple U.S. data centers and containing nearly 500,000 of our Trainium2 chips.”

Far from being a future promise, AI is delivering tangible results now.

Alphabet's AI Overviews and AI Mode are driving "meaningful query growth" in its core Search business.

Amazon Web Services (AWS) has re-accelerated to 20% growth on a $132 billion annualized run rate, fueled by AI workloads.

Meta’s AI recommendation systems led to a 5% increase in time spent on Facebook, and its AI-powered ad tools now have a $60 billion annual run rate.

Microsoft’s AI Copilots have surpassed 150 million monthly active users, and AI is a key driver behind its $392 billion commercial remaining performance obligation (RPO).

The surge in AI investment is creating a powerful downstream effect. Teradyne, a key provider of semiconductor test equipment, reported a blowout quarter and provided a Q4 forecast that shattered expectations, attributing the growth almost entirely to AI-related demand for compute, networking, and high-bandwidth memory (HBM). This confirms that the infrastructure buildout is translating directly into massive orders for the entire AI supply chain.

Companies are moving beyond simple AI features to building sophisticated "agentic" systems.

Microsoft is positioning its Copilot as an "organizing layer for agents," integrating it deeply into workflows across M365, GitHub, and Security.

“We have integrated chat and agentic workflows into everyday tools like Outlook, Word, Excel, PowerPoint and Teams. Just 9 months since release, tens of millions of users across Microsoft 365 customer base are already using chat. Adoption is accelerating rapidly, growing 50% quarter-over-quarter, and we continue to see usage intensity increased. This quarter, we also introduced Agent Mode, which turns single prompts into export quality Word documents, Excel spreadsheets, PowerPoint presentation and then iterate to deliver the final product much like agent mode in coding tools today”

Amazon is heavily investing in agents for e-commerce (Rufus), coding (Curo), and enterprise use (AgentCore).

“A lot of the future value companies will get from AI will be in the form of agents. AWS is heavily investing in this area and well-positioned to be a leader. Companies will both create their own agents and use agents from other companies. For those building their own, it's been harder to build than it should be. It's why we launched Strands to make it much easier to create agents from any foundation model that builders desire.”

The race for performance and efficiency is driving significant investment in custom-designed chips.

Google is scaling its TPUs, with plans for Anthropic to access up to 1 million units.

“We are scaling the most advanced chips in our data centers, including GPUs from our partner, NVIDIA, as well as our own purposeful TPUs. And we are the only company providing a wide range of both. As we announced yesterday at NVIDIA GTC, we are now shipping the new A4X Max instances powered by NVIDIA GB300 to our cloud customers. Our highly sought-after TPU portfolio is led by our 7-generation TPU, Ironwood, which will be generally available soon. We are investing in TPU capacity to meet the tremendous demand we are seeing from customers and partners, and we are excited that Anthropic recently shared plans to access up to 1 million TPUs.”

Amazon's Trainium 2 chip is now a multi-billion-dollar business, growing 150% quarter-over-quarter and is fully subscribed, with Anthropic using it to train its next-generation Claude model.

“So we're bringing in quite a bit of capacity today, overall in the industry, maybe the bottleneck is power. I think at some point, it may move to chips, but we're bringing in quite a bit of capacity. And as fast as we're bringing in right now, we are monetizing it. And then on the Tranium demand, outside of our major customers. So first of all, as I mentioned on Trainium2, it's really doing well. It's fully subscribed on Trainium2. We have -- it's a multibillion-dollar business at this point. It grew 150% quarter-over-quarter in revenue. And you see really big projects at scale now, like our Project Rainier that we're doing with Anthropic, where they're running their next version of -- they're training the next version of Claude on top of Trainium2 on 500,000 Trainium2 chips going to 1 million Trainium2 chips by the end of the year.”

In summary, Q3 2025 was a milestone quarter where the astronomical costs of the AI transition were justified by clear, accelerating demand and tangible revenue growth. The strategic bets placed on AI are now the central narrative, with companies locked in a fierce competition to build the foundational infrastructure that will power the next decade of technology.

Alphabet delivered a landmark quarter, achieving its first-ever $100 billion revenue quarter, a doubling of its quarterly revenue in just five years. This performance was driven by double-digit growth across every major business segment, with Artificial Intelligence emerging as a primary catalyst for expansion in Search and Cloud.

Core Business Segments -

Amazon reported strong Q3 results, with AWS re-accelerating to its highest growth rate in 11 quarters and the company's advertising business continuing its rapid expansion. The core theme was the tangible momentum in AWS, driven by enterprise demand for both core and AI workloads, backed by an aggressive capacity buildout.

Core Business Segments

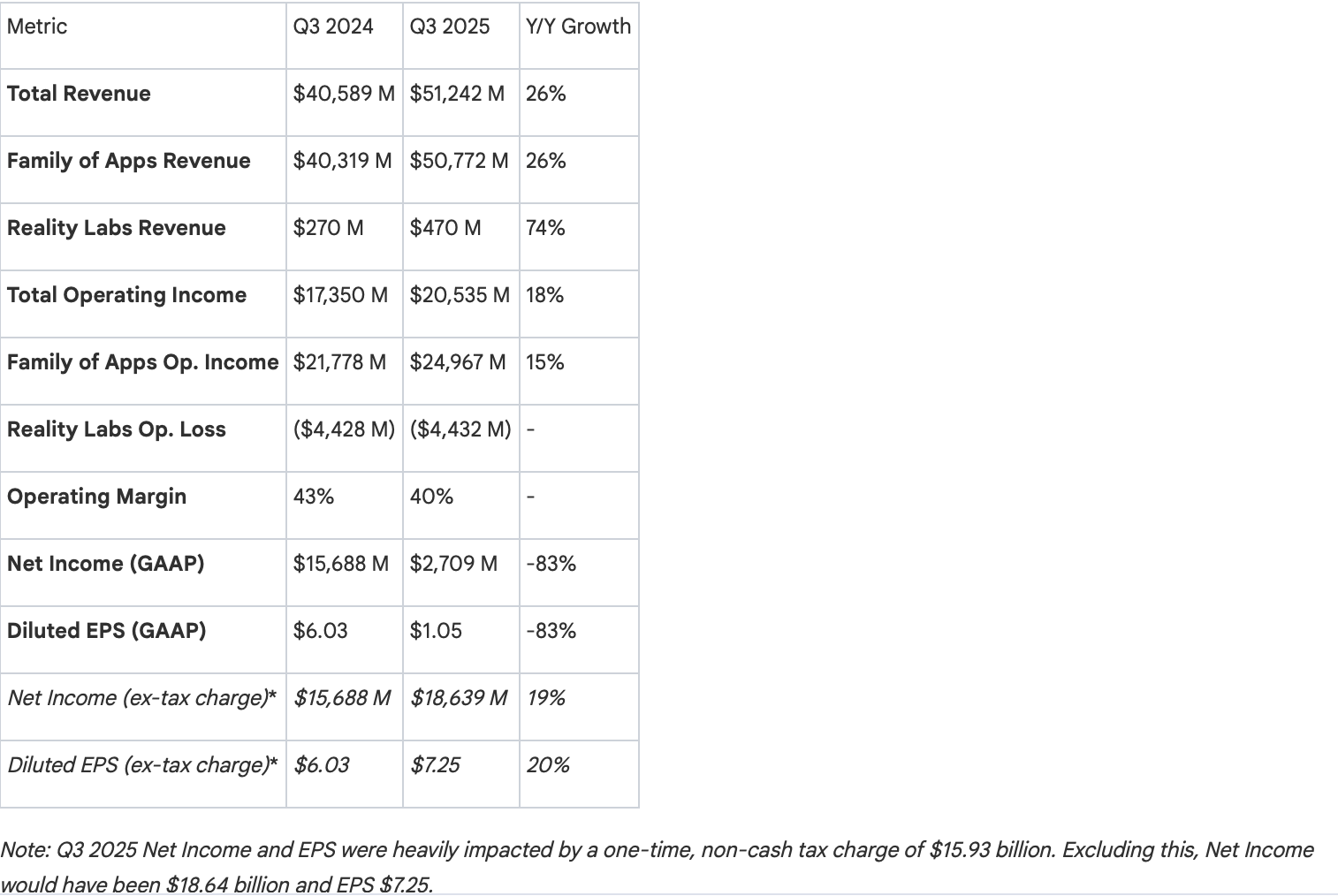

Meta Platforms reported another strong quarter of growth, with revenue up 26% year-over-year. The central message from CEO Mark Zuckerberg was an intense and singular focus on establishing Meta as the "leading frontier AI lab" with the ultimate goal of building "personal superintelligence for everyone." This ambition is backed by a strategic decision to "aggressively front-load building capacity," signaling a period of massive investment in compute infrastructure.

Business and Product Highlights

The Super-intelligence Strategy and Investment Outlook

Meta's forward-looking commentary was dominated by its aggressive AI infrastructure buildout.

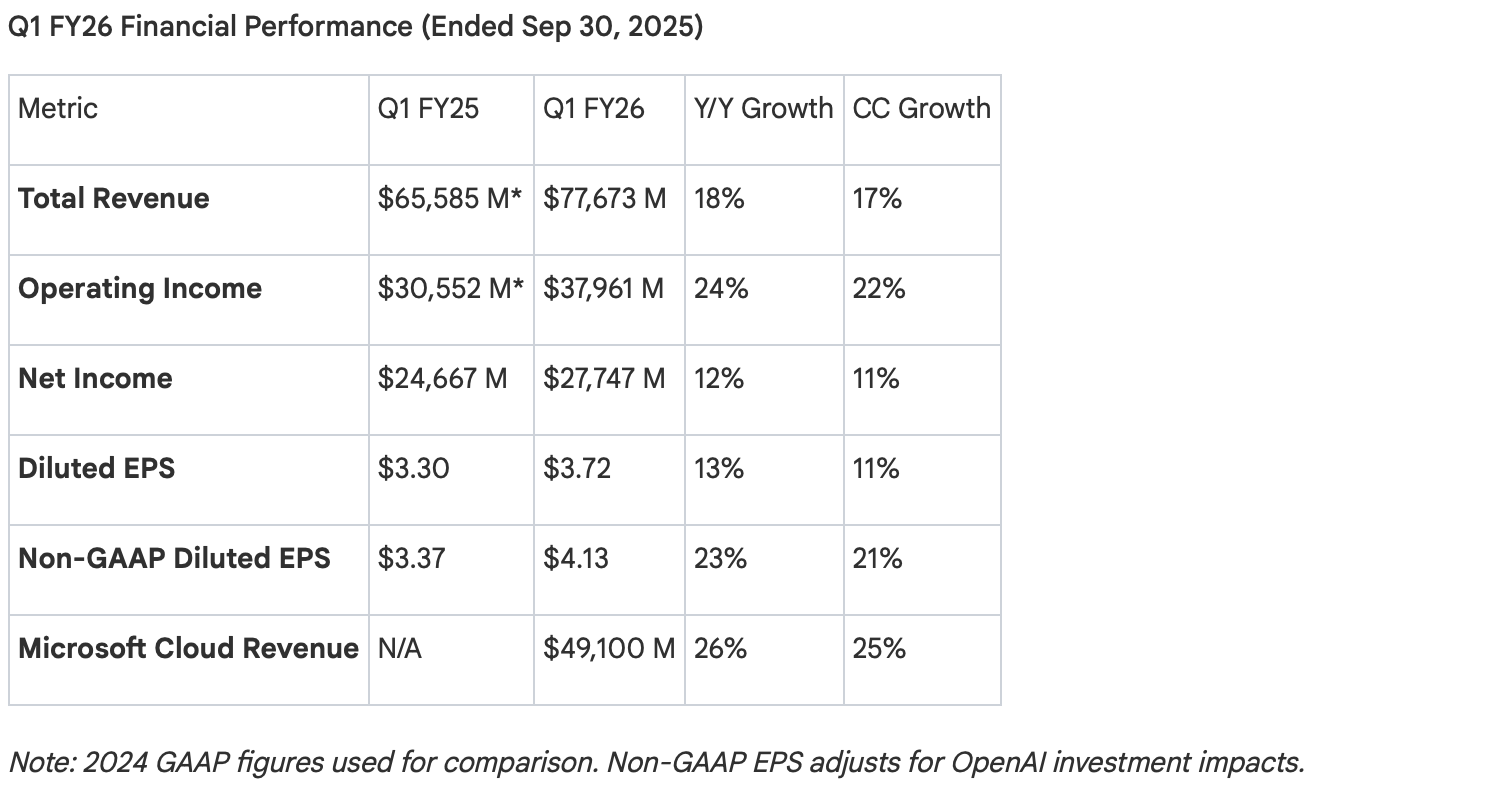

Microsoft reported a powerful start to its fiscal year, with results significantly exceeding expectations. The company is experiencing a massive wave of commercial demand, directly tied to its comprehensive AI platform and family of Copilot products. This momentum is reflected in a record-breaking commercial RPO and a new, expanded partnership with OpenAI that adds a staggering quarter-trillion dollars in future Azure commitments.

Commercial and Segment Highlights

Expanded OpenAI Partnership & AI Strategy

The quarter was defined by the deepening of Microsoft's pivotal partnership with OpenAI.

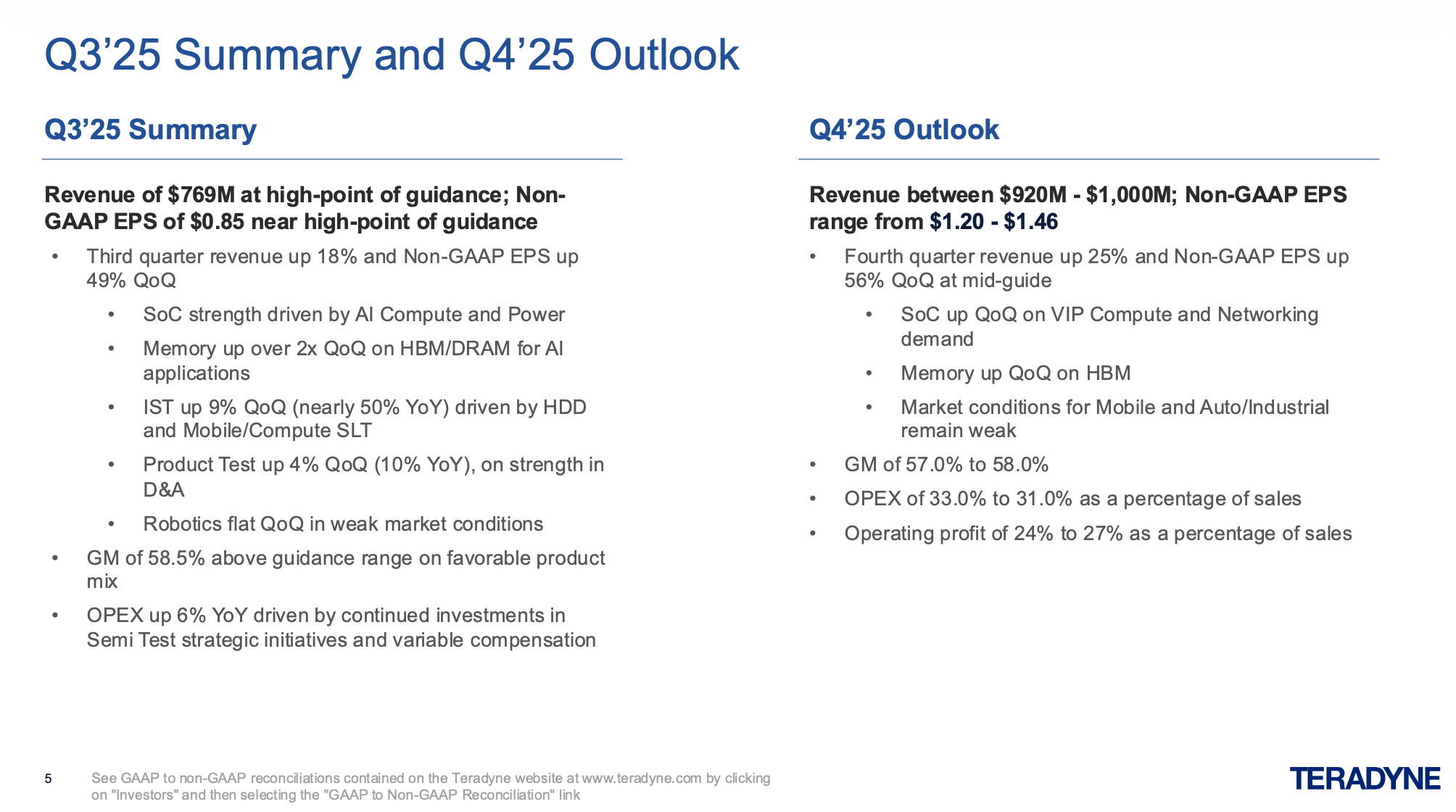

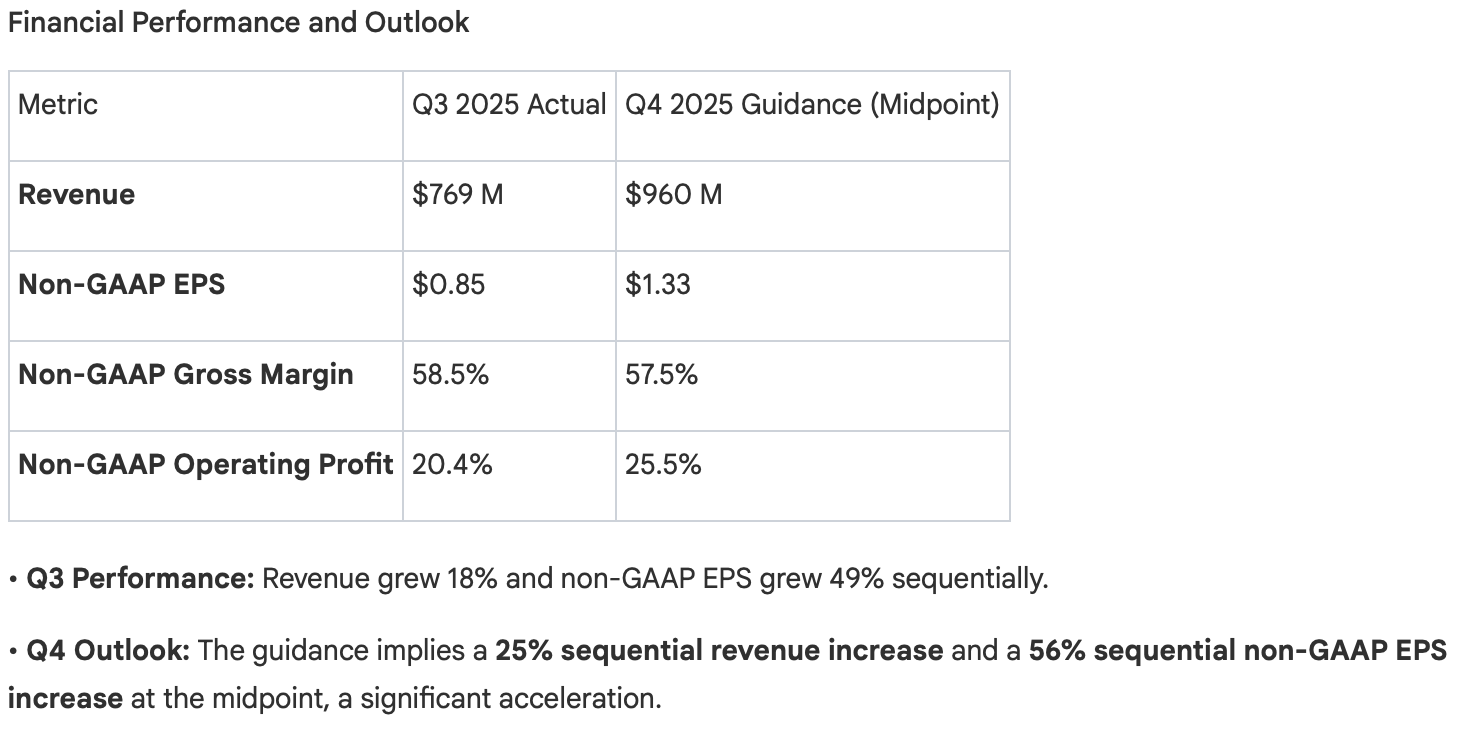

Teradyne, a leading supplier of automated test equipment, provided a clear signal that the AI infrastructure boom is translating into massive, tangible orders for the semiconductor supply chain. The company reported strong Q3 results and issued a Q4 revenue forecast that significantly surpassed expectations, with CEO Greg Smith attributing the strength almost entirely to AI-related demand.

Key AI-Driven Business Segments

Smith stated, "the largest demand driver is AI data center investments rather than consumer end markets." He noted that from Q3 to Q4, the portion of total company revenue coming from AI-driven segments is projected to rise from 50% to 60%.

Semiconductor Test (SoC & Memory):

AI as the Dominant Driver:

“I mentioned in closing the July call that AI was having a profound and positive impact on Teradyne's business. I'm encouraged by how quickly we're seeing returns on our investments to pivot to AI. AI is the dominant driver of our business for the foreseeable future and will continue to align ourselves to the outsized opportunities that it offers. We've made great strides so far in 2025 and while our progress is not expected to be entirely linear, we're more excited than ever about our prospects for continued profitable growth in the years ahead. Thanks for joining us today, and I look forward to updating you on our progress in January”

Market Share Opportunities:

“So those sort of environmental factors really make us think that the test intensity for the computer segment is going to continue to grow over the next few years. The other thing that's happened in compute is that because it's now the primary driver for the semiconductor industry that many of the strategies that we've seen in the mobile space for years and years around things like dual sourcing, are becoming much more important to the producers in this space, like the strategy that you need when you're a small portion of your capital equipment providers, overall shipments is different when you actually dominate those shipments. You start to feel a little bit more vulnerable. And so customers in this space are increasingly turning to this notion of dual sourcing their supply chain at every step. And since we're coming from a lower share position trying to gain share, that dual sourcing is actually a very good thing for us.”

Q3 2025 was not merely a strong earnings period; it was a fundamental inflection point. The "AI arms race" has moved from a strategic concept to the single most dominant force driving the technology sector. The staggering capital expenditure figures—$24 billion in a single quarter for Alphabet, $34.9 billion for Microsoft, and a commitment from Meta to "notably" accelerate spending in 2026—are not speculative bets. They are the new cost of doing business at the top.

The blowout quarter from Teradyne serves as the ultimate validation, proving this boom is not confined to cloud software. It has triggered a massive, physical buildout of the entire semiconductor supply chain, from HBM to custom networking.

Disclaimer - This blog is only for educational purpose and not a recommendation to buy or sell

0 Comments