%2016_9.png)

This week’s tape stayed sideways, but the signals were clear. We’ve distilled the noise into what actually moves portfolios: where earnings surprised for the right reasons, which companies put real money into capex, who printed fresh order wins, how market breadth is shifting under the surface, and the most useful one-liners from management calls of this week.

What’s inside

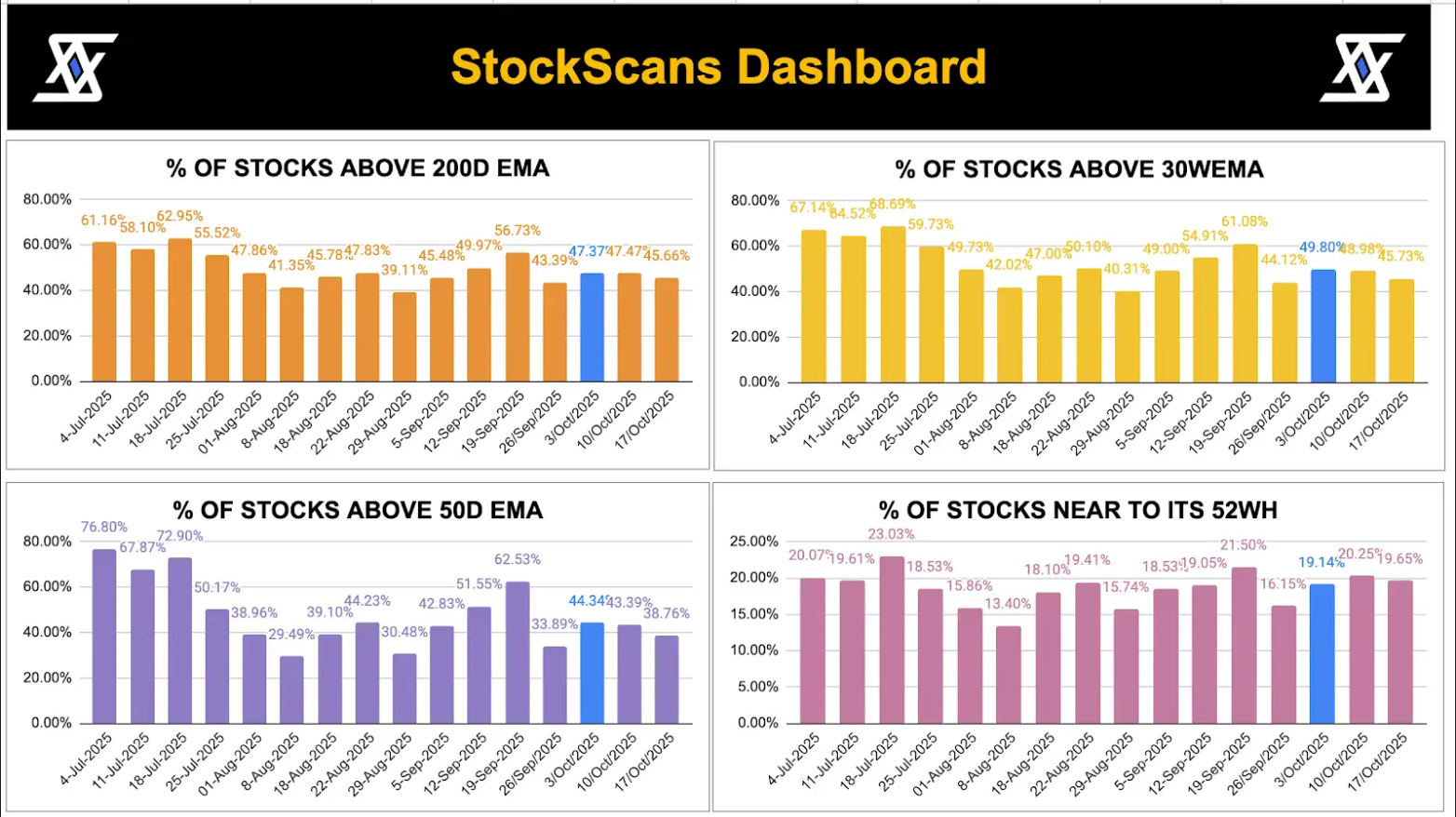

Market breadth continues to remain sideways and not much of a change in statistics of dull markets with respect to breadth in the last few weeks. However there can be increased volatility in times to come as we are in the middle of Q2FY26 results .

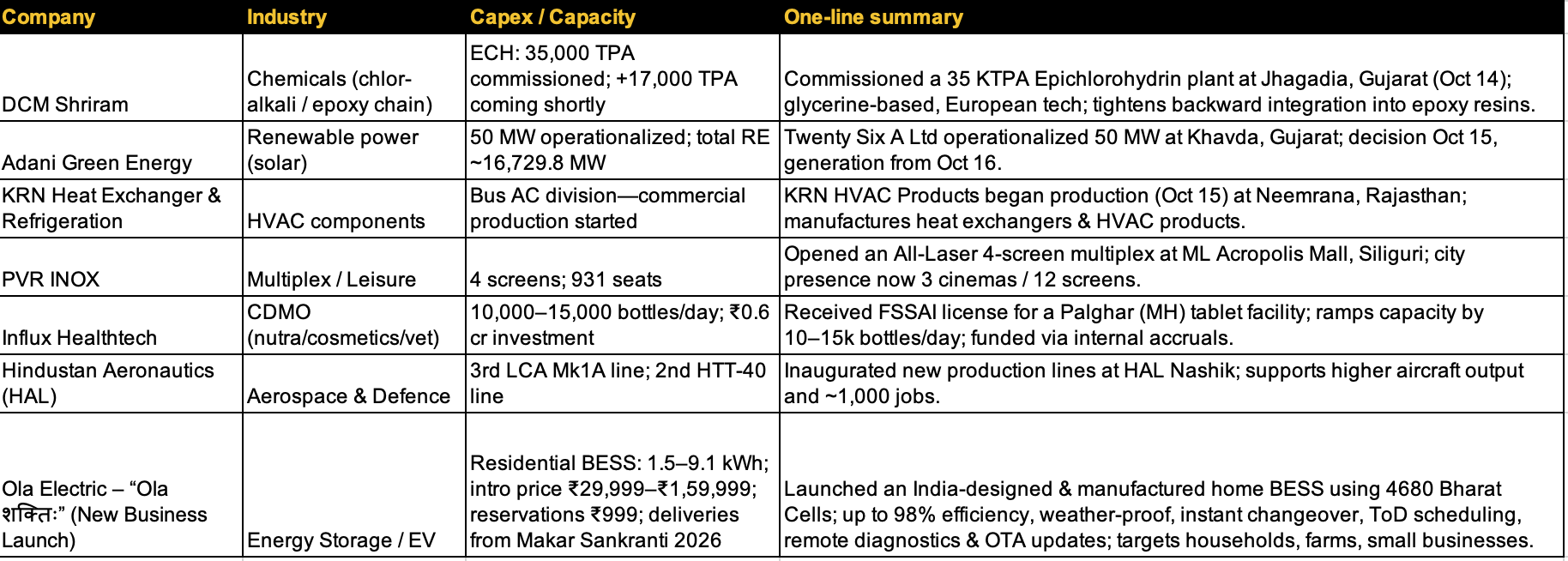

Power & grid capex still on track L&T’s multi-country T&D wins plus Viviana’s Gujarat MoUs signal sustained spend on interconnects, 132/380/400kV infra and RE integration a familiar tailwind for suppliers across towers, conductors, transformers, GIS/AIS and EPC services.

Data-center build-out is broadening. The Airtel–Google plan (US$15bn, 2026–30) is a marquee confirmation; Aeroflex’s liquid-cooling order shows the value chain pull-through into components and thermal solutions.

Solar manufacturing demand stayed firm. Saatvik (₹639 cr) and Solex (₹545 cr) together reflect healthy domestic procurement by IPPs/EPCs; Servotech adds distributed rooftop momentum via railways.

Defence & offshore steady contributors. BEL keeps stacking incremental orders across platforms & subsystems; Shipbuilder Cochin shipyard also received export order for a German Shipbuilder, Shipbuilding a theme which is in middle of an order inflow cycle both domestically and Internationally with both Indigenisation defence orderbooking and Commercial cycle converging together

Broadly order win themes have been around Power, Renewables , Grid Infrastructure this has been a theme which is witnessing Global capex from quite sometime.

Added to this Data center capex announced by Google in partnership with Airtel worth 15 billion dollars was magnificent and even the previous week we had seen TCS announce its first ever Data center capex announcement for the first time ever . A theme which is broadly playing out together .

Ola had an interesting development with the launch of Residential BESS named Ola shakti with Indigenous designed and manufactured using 4680 Bharat cells . HAL Nashik lines for LCA Mk1A and HTT-40 signal sustained execution against the order book; monitor staffing ramp and vendor throughput

Acutaas Chemicals Ltd Margin-led beat: operating leverage and a richer product mix with a solid boost in Advanced Pharmaceutical intermediates lifted EBIT sharply, turning mid-20% yoy revenue growth into ~80%+ you operating profit growth.

Jayaswal Neco Industries Ltd Turnaround on core ops: better realizations/volumes in steel & DI pipes plus cost control swung PAT positive and expanded margins. Company has also released its first ever Investor presentation

Polycab India Ltd Broad-based strength: wires & cables volumes stayed firm across retail + infra; stable input costs and mix/pricing discipline drove strong EBITDA expansion

Pondy Oxides & Chemicals Ltd Spread tailwind: improved lead/alloy spreads and higher value-added mix boosted EBITDA per tonne, delivering triple-digit YoY PAT growth . The new facility’s operational efficiency is now visible in the margin profile of the company .

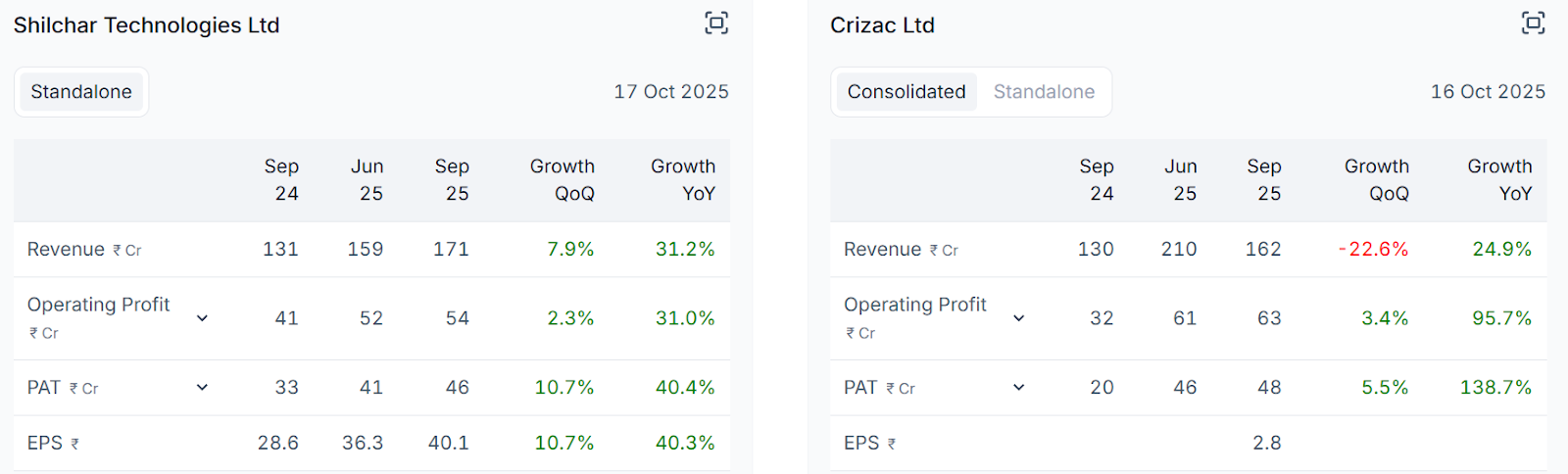

Power and Power ancillaries have continued to showcase resilient earnings growth. Proxies such as Kei Industries and Polycab continue to grow beyond 20% yoy . And Waaree energies , Shilchar continues to benefit from energy capex .

Shilchar Technologies

"In spite of 50% tariffs customers are absorbing the duty”

New product launch / capacity addition

Gavasad Expansion-3: Adds 6,500 MVA (to 14,000 MVA total) by Apr’27; capex ~₹90 cr, fully via internal accruals. Management expects both top-line and margin benefits from this move-up in rating class.

Acutaas chemicals :

Advanced pharmaceutical Intermediates : This segment was the primary growth driver, reporting revenue of INR 262.6 crores, a strong YoY growth of 27.1%. The growth was led by the CDMO business, supported by stable performance from the core API business. The company is strategically restructuring this segment's portfolio by phasing out low-margin products, which has resulted in a better product mix and significant margin expansion.

New products being sent as validation batches

The CDMO pipeline continues to expand. During the quarter, the company dispatched validation batches for a couple of new products. These products are expected to start contributing to revenue by the end of FY26 (Q4), subject to regulatory approvals.

Pondy Oxides and chemicals

“Current ebitda margins of 8% are sustainable”

Current ebitda margins of 8% is a result of operational efficiency and can be sustainable . Second Phase of the lead capacity addition to become in production in H2 of this year leading to healthy volume growth .

This week's Investor Edge clearly illustrates a dynamic market environment, driven by strong corporate performance, strategic investments, and significant order inflows across key sectors. These trends, coupled with evolving market breadth and insightful management commentary, collectively paint a picture of ongoing shifts and emerging opportunities for investors.

Disclaimer - This is only for education purpose and not a recommendation to buy/sell

0 Comments