%20(1).png)

Imagine you’re driving down a brand-new highway, smooth as silk. A flyover stretches over your head, leading to a massive solar park. Cranes are busy working at an airport terminal nearby. Ever wonder what holds these massive structures together?

The world may run on oil, but India’s growth story is built on concrete. And guess who’s supplying the tools to mix, move, and pour it? Yep — Ajax Engineering. But to truly appreciate what’s driving Ajax's explosive potential, we need to understand the concrete jungle it thrives in. Concrete. And behind the scenes of this silent superhero of infrastructure is a fascinating story — the story of Ajax Engineering, the company that’s literally building India’s backbone, one mixer at a time. This is a tale of machines, innovation, and India’s construction revolution, where Ajax has cemented its spot at the top.

Let’s rewind to the 90s. In most parts of India, concrete was still being mixed manually — a slow, inconsistent, labour-intensive process. Now fast forward to today, and you’ll see sleek machines mixing, moving, and pumping concrete on highways, bridges, canals, and power plants.

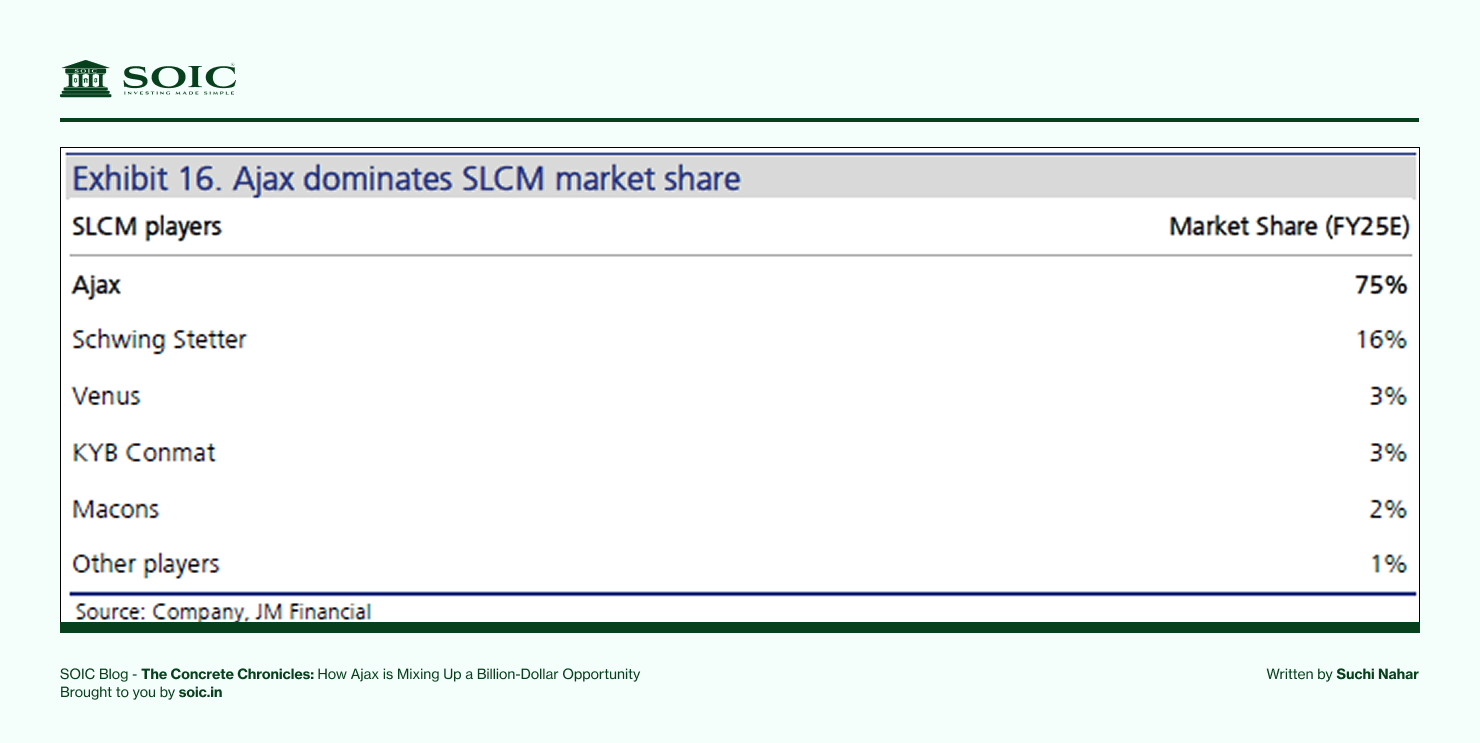

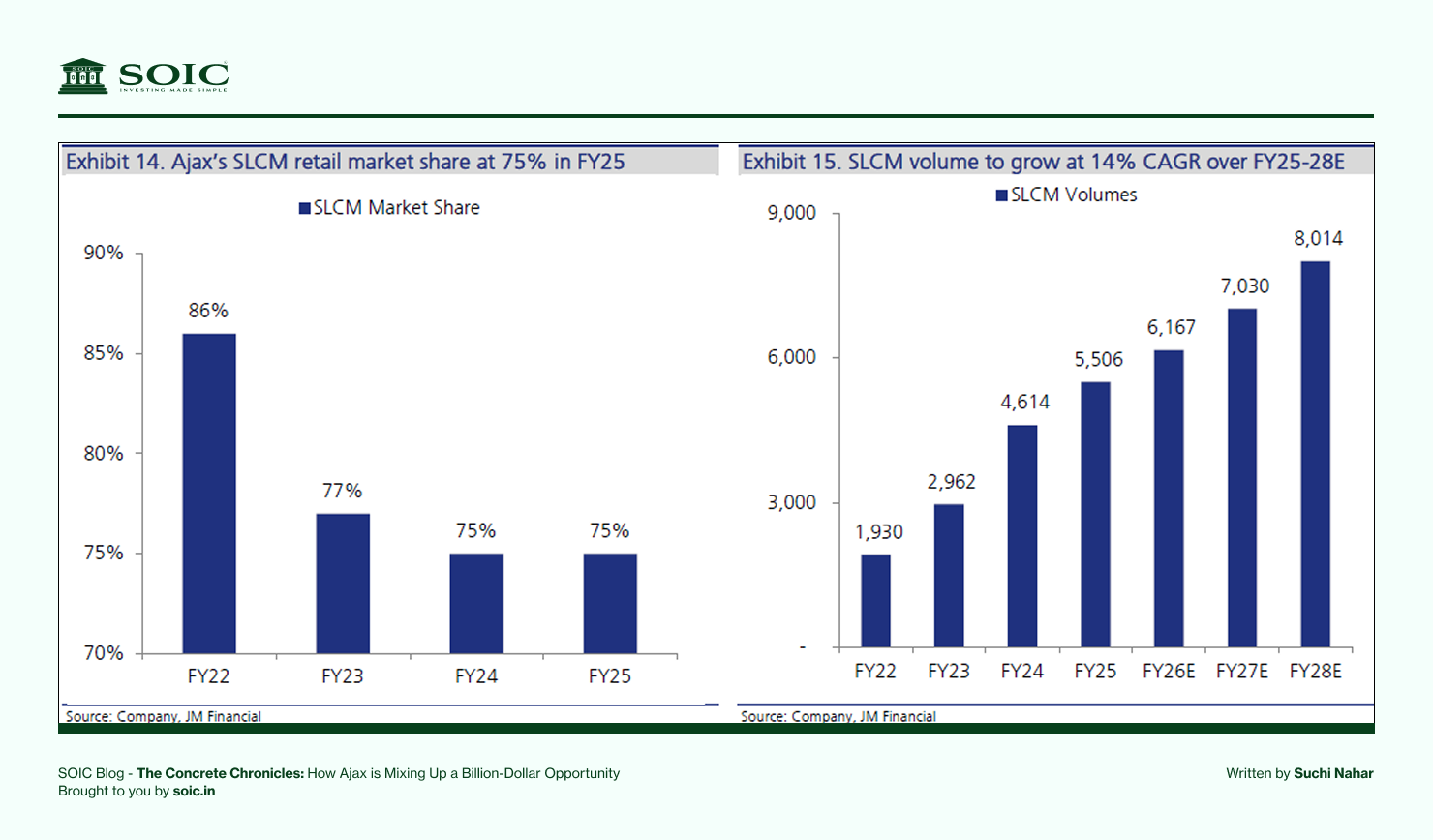

At the heart of this transformation is Ajax Engineering, born in 1992 and now the undisputed king of Self-Loading Concrete Mixers (SLCMs), with a whopping 75% market share in India.

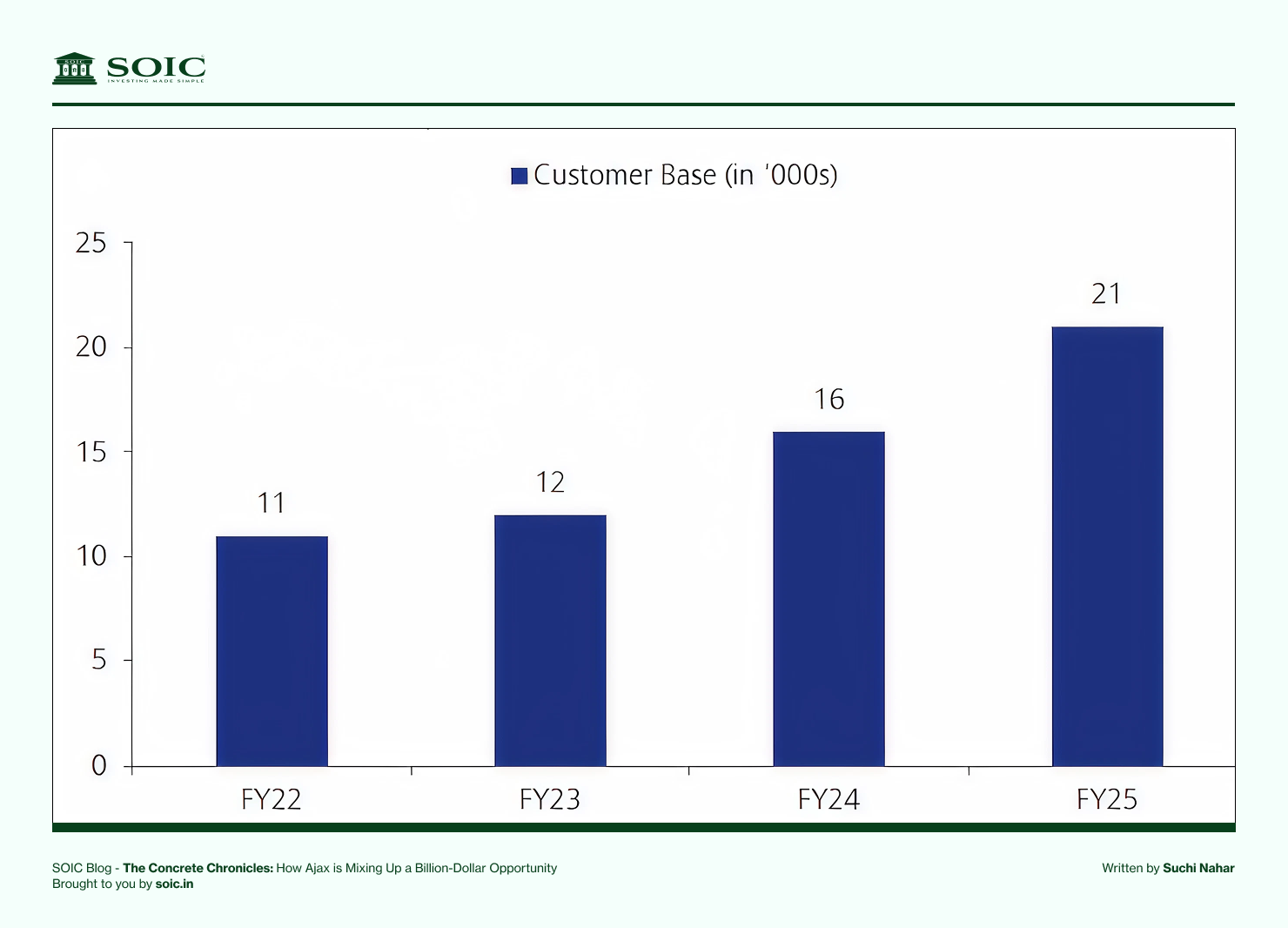

Ajax’s machines are everywhere — roads, dams, metros, irrigation projects, solar farms, even 3D concrete printing! Over the last 10 years, they've sold over 33,000 concrete machines to over 21,000 customers.

That’s not just scale. That’s dominance.

Concrete Consumption in India: A Sleeping Giant Awakens

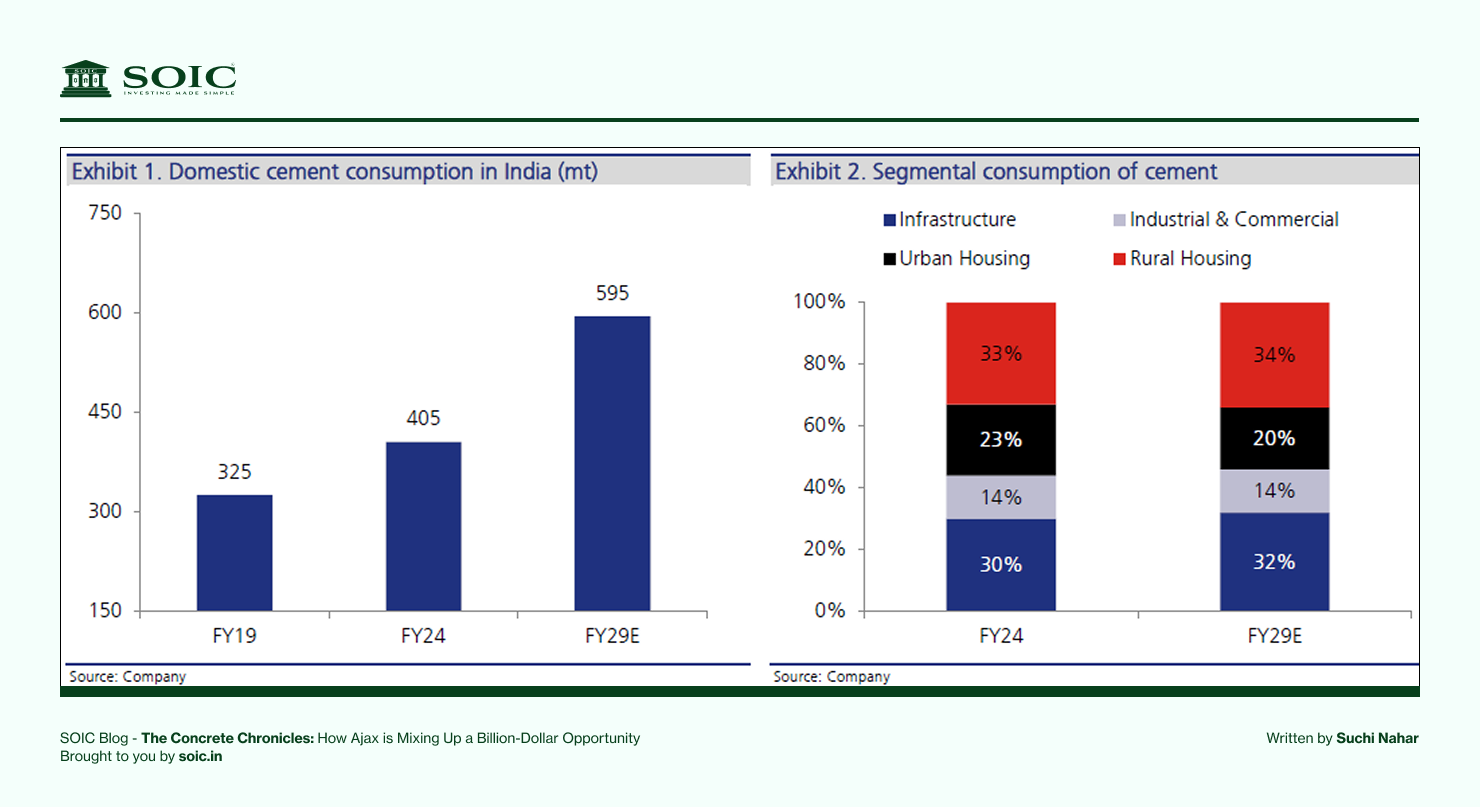

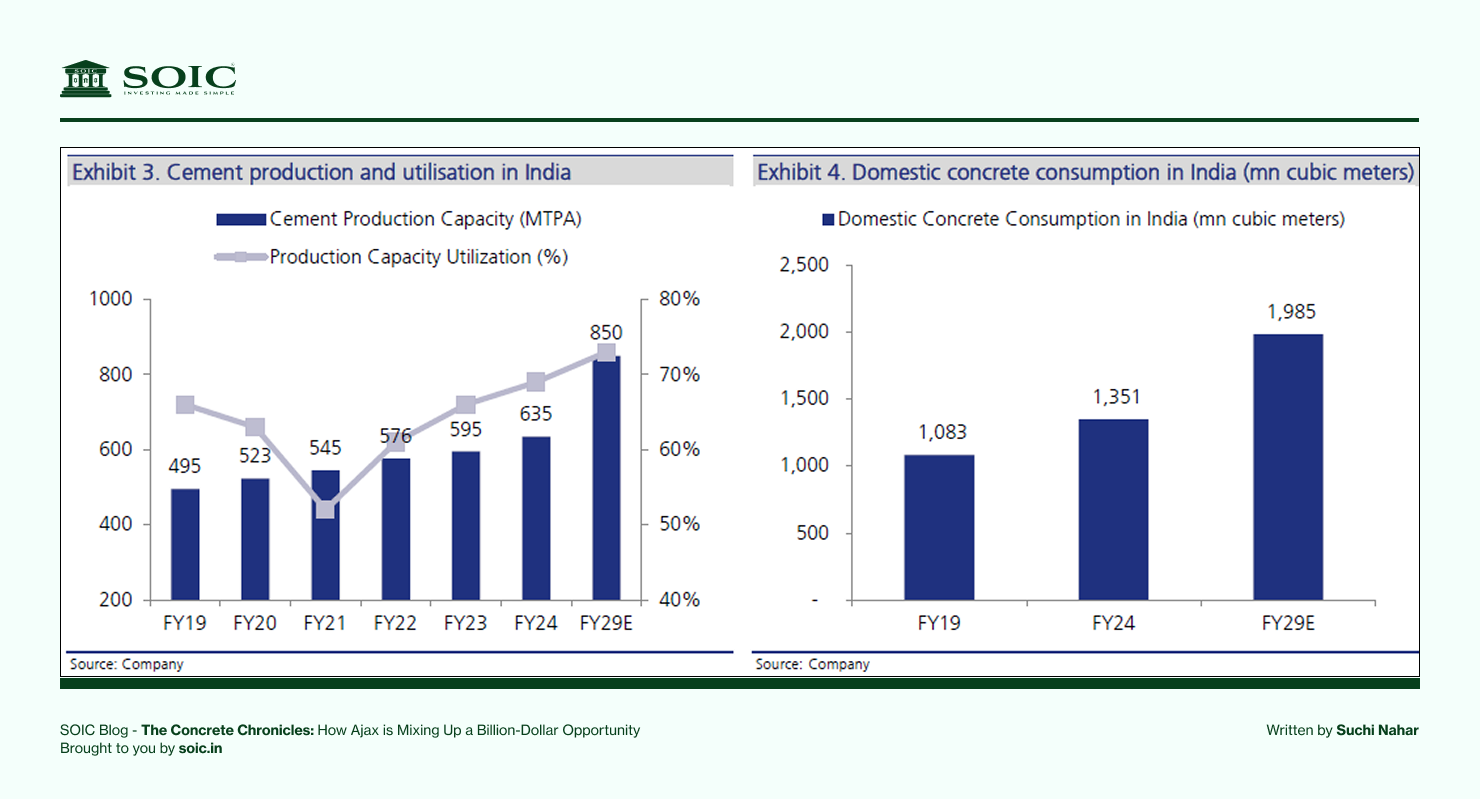

India’s domestic concrete consumption stood at around 1,351 million cubic meters in FY24, and it’s expected to hit nearly 2,000 million cubic meters by FY29, growing at a steady 8% CAGR. This isn’t just demand growth — it’s a paradigm shift.

What’s fuelling it?

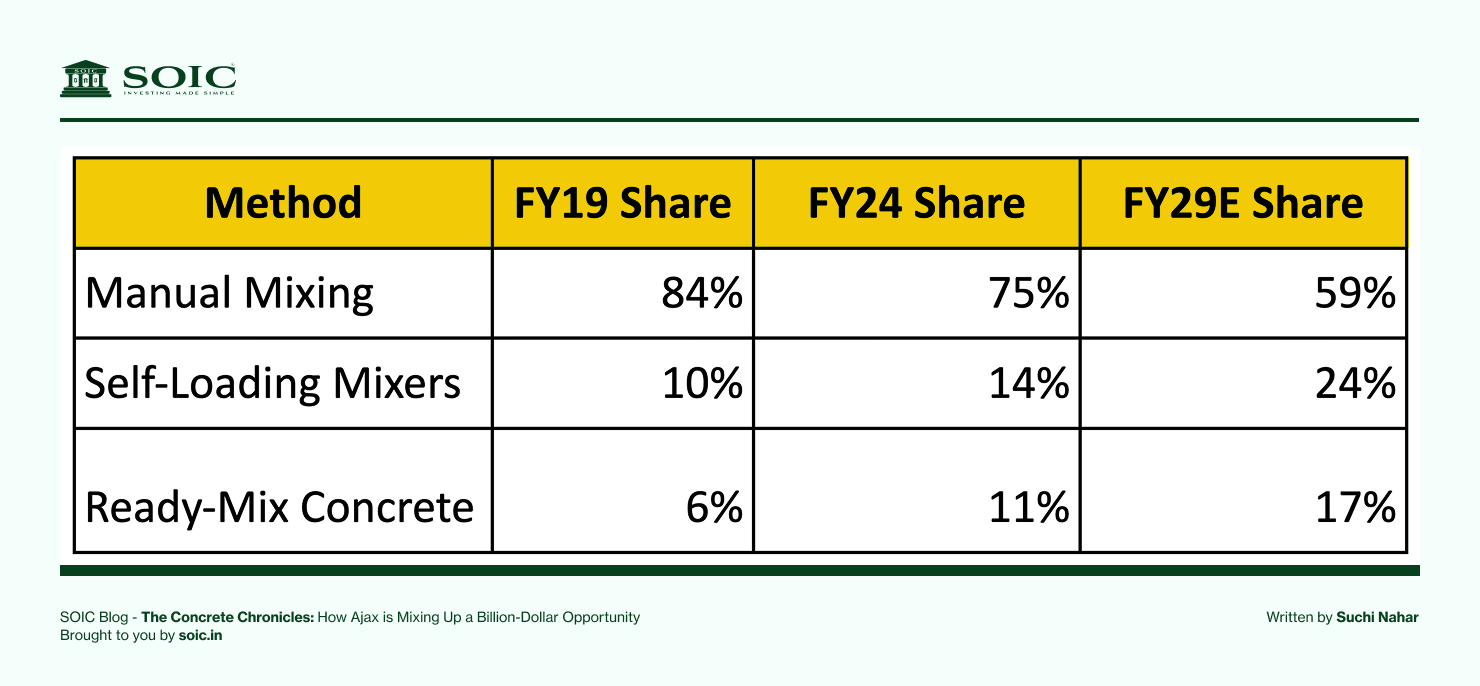

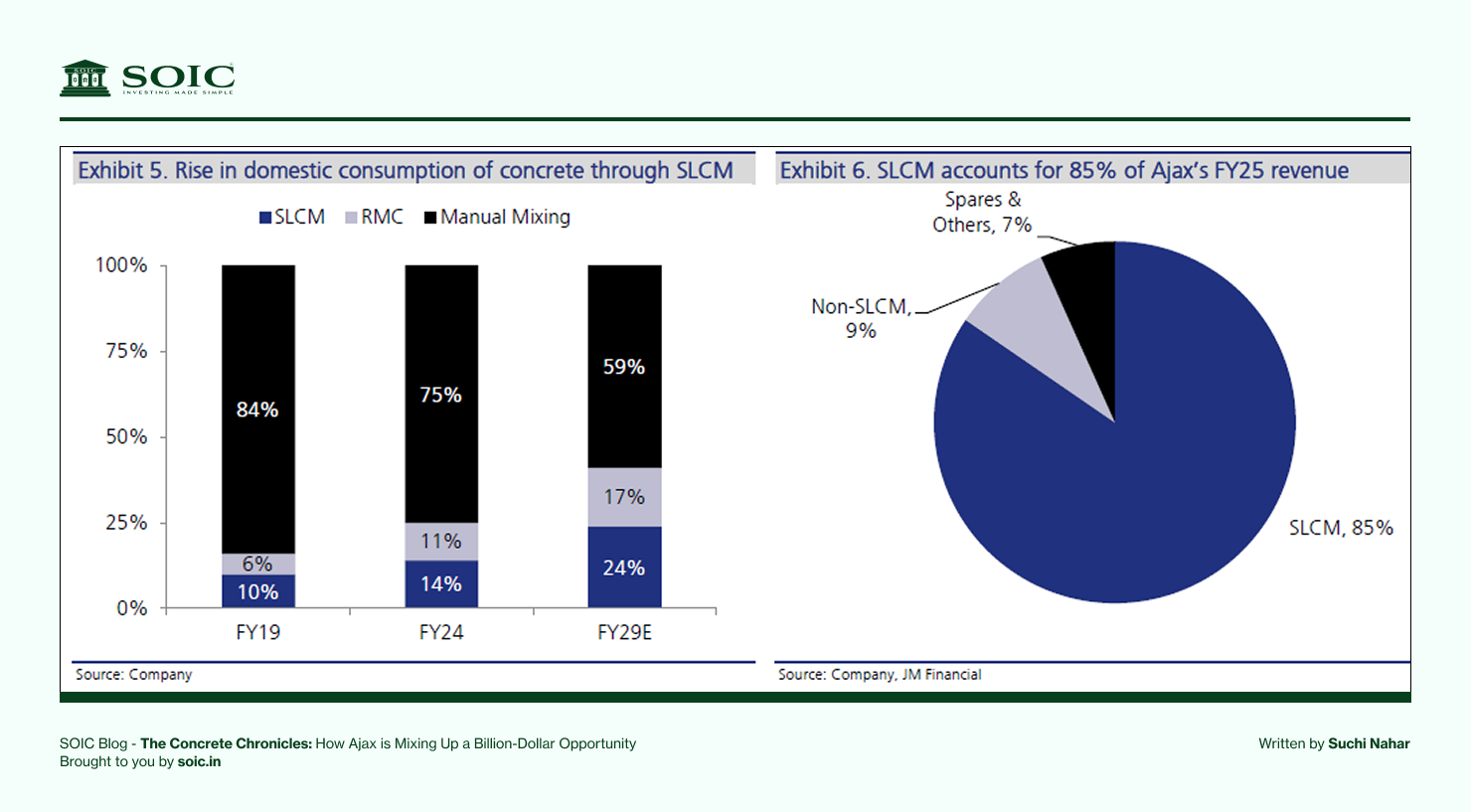

Here’s the twist — despite this boom, manual mixing still accounts for 75% of concrete production in FY24.

That’s where mechanisation steps in

Mechanisation: The Mega Trend That Ajax Rides

India is transitioning rapidly from manual to mechanised concrete production, and the numbers are telling:

As mechanisation becomes mainstream, SLCM adoption is expected to nearly double by FY29 and Ajax dominates this space — with a 75% market share in SLCMs. There’s simply no bigger beneficiary of this trend.

India consumes a lot of concrete — and it’s only going to increase, thanks to the boom in rural housing, urban infrastructure, and industrial expansion.

Here’s the kicker:

As of FY24, 75% of concrete in India is still mixed manually. By FY29, that number is expected to drop to 59%, with mechanised methods (SLCMs and RMC) taking over.

Ajax stands to benefit the most from this shift. Their flagship ‘ARGO’ line of SLCMs is known for being rugged, reliable, and resale-friendly. Whether it’s a tunnel in Himachal or a flyover in Hyderabad, Ajax machines are doing the heavy lifting.

And they’re not stopping there. They’re about to launch smaller, more affordable SLCMs, targeting local contractors still stuck with manual mixers. It’s like giving a smartphone to someone using a landline. Game. Changer.

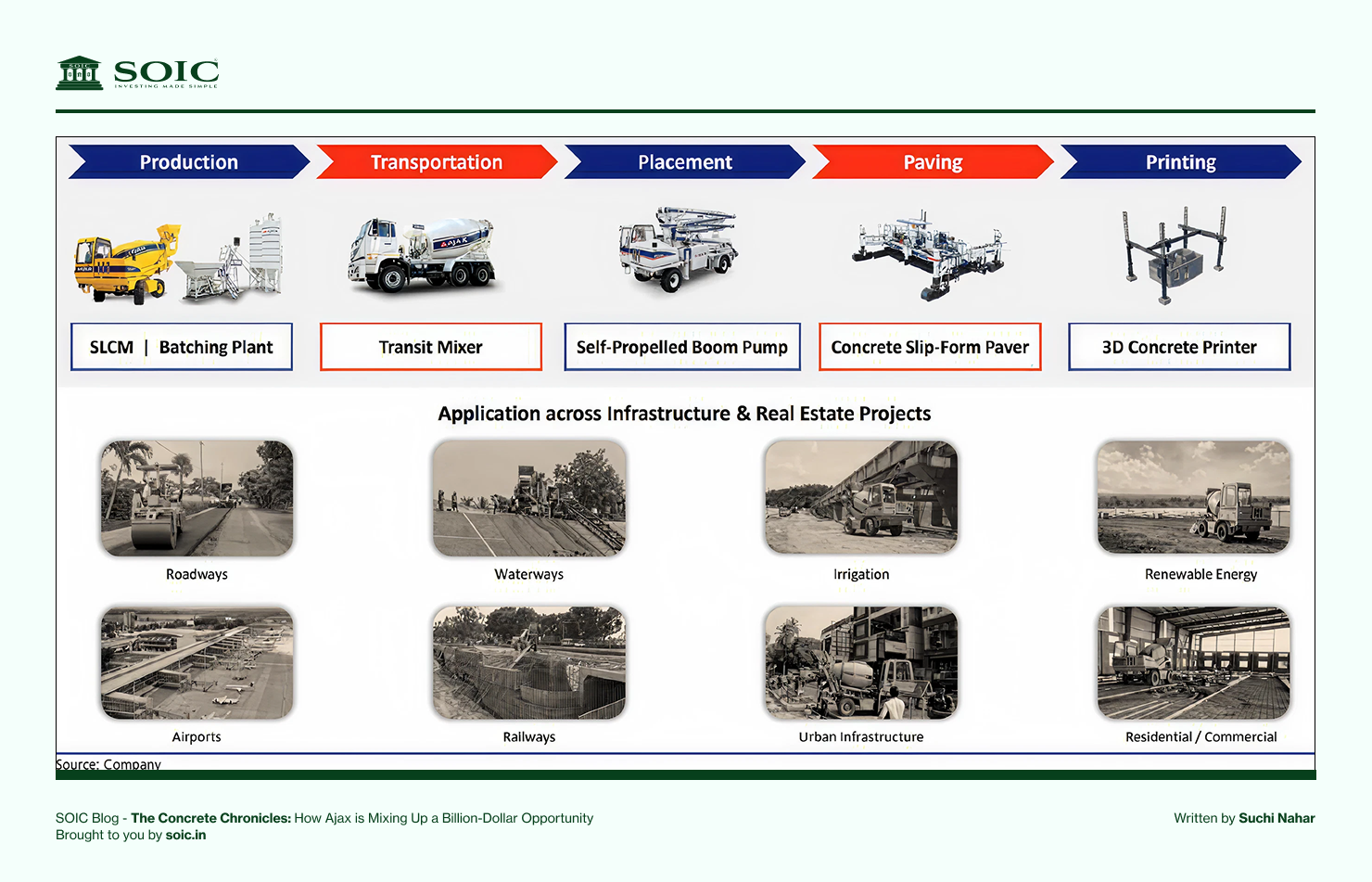

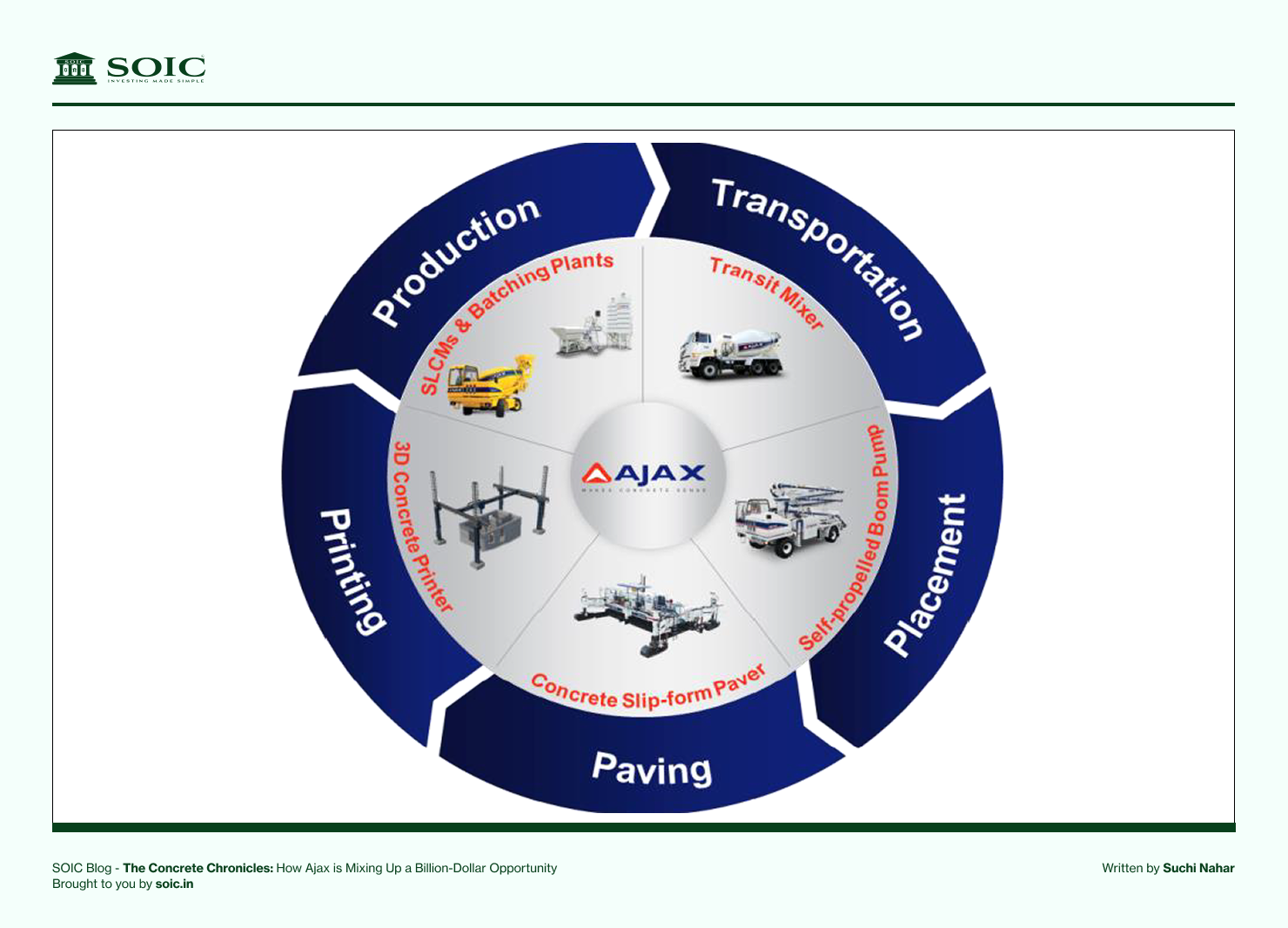

While SLCMs make up 85% of Ajax’s revenue today, the company has big ambitions beyond mixing. Their non-SLCM portfolio — batching plants, transit mixers, boom pumps, slip-form pavers — is expanding fast. From FY22 to FY25, this segment grew at 22% CAGR, and is expected to grow even faster going forward.

Why does this matter?

Because Ajax is quietly becoming a full-stack concrete solution provider, covering the entire concrete lifecycle: mix, move, place, and pave. They’re even working on 3D concrete printers for futuristic structures!

This is diversification done right — not just for growth, but also to reduce reliance on one product category.

The Factory that Never Sleeps

Ajax isn’t just about machines; it’s about innovation and scale. With 4 manufacturing facilities in Karnataka and a massive 5th plant coming up, they’ve built one of the largest SLCM facilities in the world. And it’s not just assembly — their R&D team of 70 engineers is creating cutting-edge tech like load cell-based SLCMs that ensure perfect concrete quality every time.

They also run the Ajax School of Concrete (TASC) — a training and innovation hub focused on skilling people and developing smarter, more sustainable concrete solutions.This is what a 21st-century engineering company looks like.

Exploring opportunities for inorganic growth

Ajax is committed to ongoing organic growth initiatives while also aiming to strategically pursue acquisitions. These acquisitions will not only focus on its current product lines within the concrete equipment market but will also explore other high-potential product lines that align with its engineering, design, and development capabilities.

The company seeks acquisitions that provide technological synergies, expand its customer base, and enhance its geographic reach. These strategic moves are designed to complement Ajax's organic growth efforts, particularly in international markets, thereby increasing its export activities and enhancing its global presence. As of March 2025, Ajax has cash and current investments totaling INR 7.2 billion.

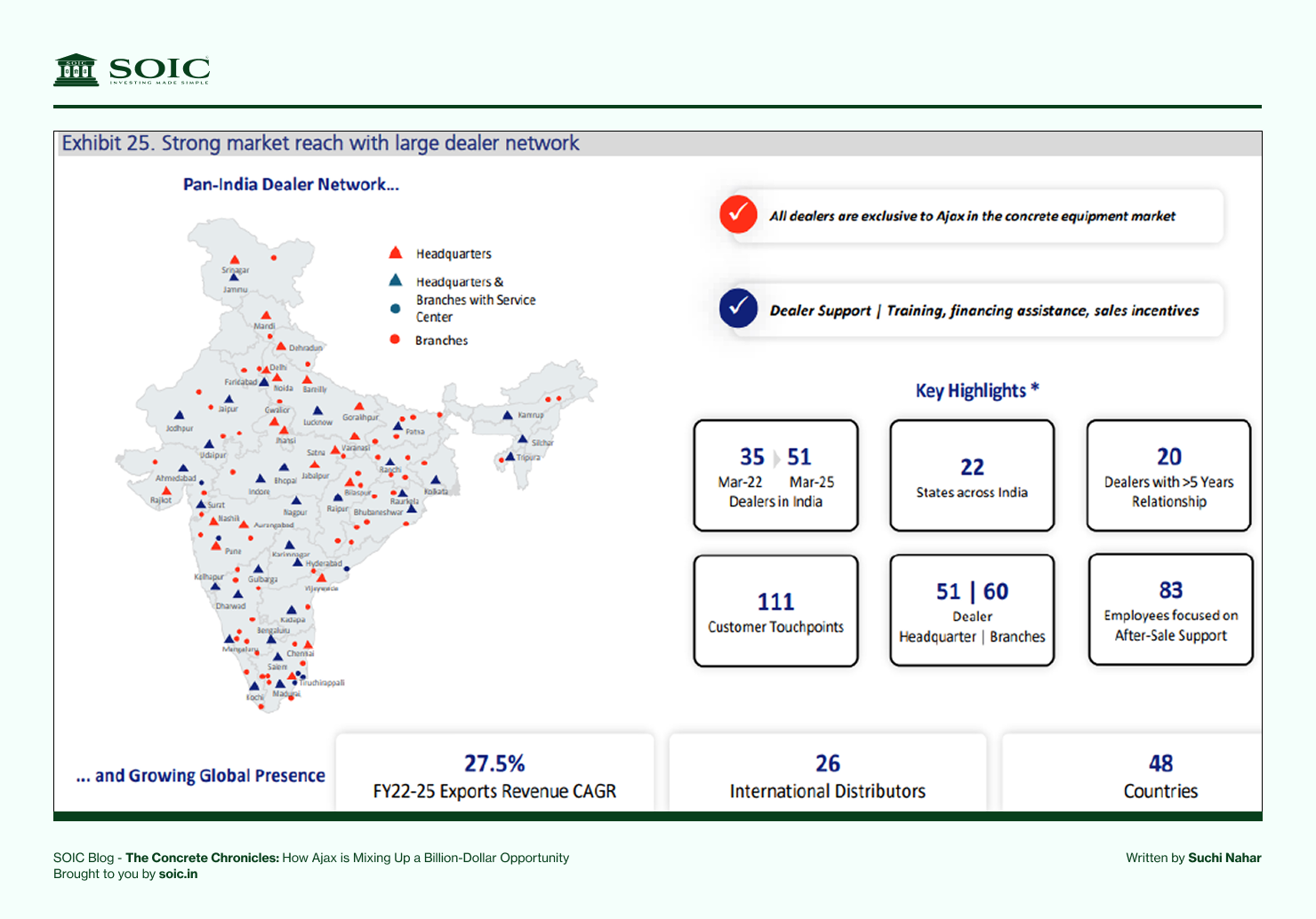

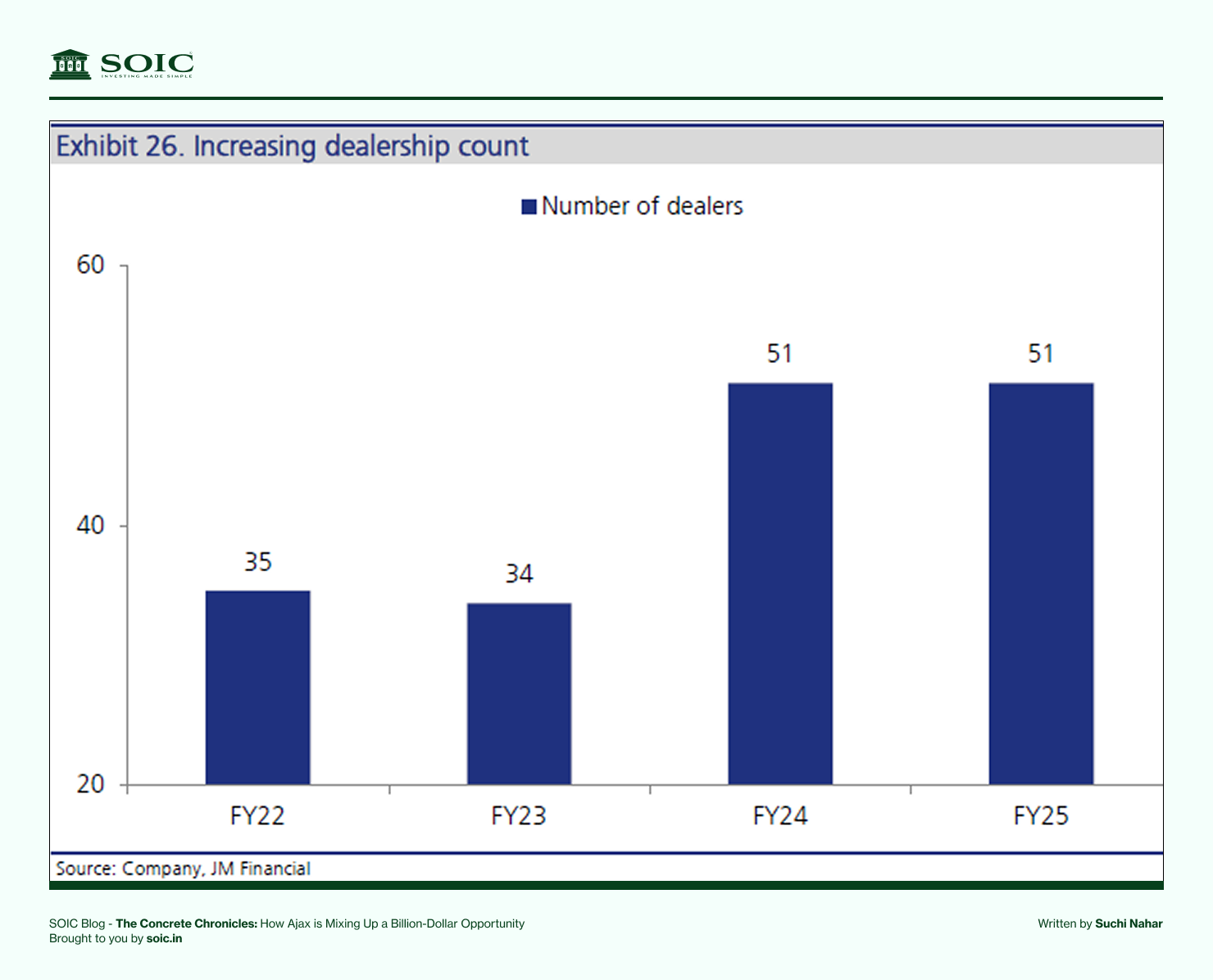

Dealerships, Data, and Distribution

You can’t dominate India without boots on the ground. Ajax has built a dealer army of 51 partners across 22 states, and 111 touchpoints for service and support.

Their dealers aren’t just sales agents — they’re long-term allies, with many relationships lasting over 5 years. Add to that their presence in 48 countries globally, and Ajax is well on its way to becoming an international concrete giant.

Concrete Equipment Market: Expanding Like Wet Cement

The total concrete equipment market in India doubled from INR 44 billion in FY19 to INR 88 billion in FY24, and it's projected to grow at a 21% CAGR to INR 230 billion by FY29.

But here’s what’s really exciting:

Mechanised equipment market alone will grow at 24% CAGR, reaching INR 178 billion by FY29

SLCMs — Ajax’s core — will jump from INR 21 billion in FY24 to INR 60 billion in FY29. Even other segments like boom pumps, batching plants, and transit mixers (where Ajax is expanding) are growing at 25-29% CAGR. In other words, Ajax is operating in a fast-expanding pie — and it already has the biggest slice.

Small Contractors = Big Opportunity

A large chunk of concrete usage in India happens in low-volume projects — rural roads, schools, hospitals, local bridges, and homes. These are mostly still manual-mix projects because of cost sensitivity. Ajax is planning to launch lower-cost SLCMs targeted at these small contractors — helping them upgrade while creating a whole new volume segment for the company.

It’s like giving two-wheelers to a country of cyclists.

This democratisation of mechanisation could unlock exponential growth.

Small Contractors = Big Opportunity

A large chunk of concrete usage in India happens in low-volume projects — rural roads, schools, hospitals, local bridges, and homes. These are mostly still manual-mix projects because of cost sensitivity.

Ajax is planning to launch lower-cost SLCMs targeted at these small contractors — helping them upgrade while creating a whole new volume segment for the company. It’s like giving two-wheelers to a country of cyclists. This democratisation of mechanisation could unlock exponential growth.

Management Views:

Key Risks to Watch

Ajax Engineering finds itself at the intersection of a shifting industry landscape and growing infrastructure demand. With its deep-rooted presence in self-loading concrete mixers, expanding product portfolio, and strong manufacturing base, the company is well-placed to participate in India’s ongoing transition toward mechanised construction.

At the same time, a concentrated revenue base, evolving regulatory norms, and operational dependencies present areas that warrant close monitoring.

As the construction sector continues to evolve — shaped by policy, innovation, and economic cycles — how Ajax adapts and scales across verticals will be worth observing. Whether it's riding the next wave of mechanisation or navigating industry shifts, Ajax’s journey will likely mirror the broader concrete story of a developing India — steady, structural, and shaping what lies ahead.

Disclaimer:

The information provided in this reference is for educational purposes only and should not be considered investment advice or a recommendation. As an educational organisation, our objective is to provide general knowledge and understanding of investment concepts. We are SEBI-registered research analysts.

It is recommended that you conduct your own research and analysis before making any investment decisions. We believe that investment decisions should be based on personal conviction and not borrowed from external sources. Therefore, we do not assume any liability or responsibility for any investment decisions made based on the information provided in this reference.

0 Comments