“Indians no longer just buy cars – they buy comfort, design, and recognition.”

A decade ago, India’s auto market was built on affordability. “Kitna deti hai?” was the single question that decided success. But today, car buyers ask a different one – “Does it have a sunroof?”

India’s roads are reflecting its economic story. The same population that once queued for budget hatchbacks now waits months for SUVs. Chrome, screens, and designs like is it a Batman Edition have replaced mileage and maintenance as the new decision triggers.

This is the rise of premiumisation in Indian mobility – a deep structural trend where economic progress meets aspiration.

Economists call this stage the Engel’s Law inflection – as incomes rise, spending on basics (like food) declines, freeing wallets for discretionary items.

Every wealth-creating sector in India has followed a similar pattern:

Value addition → Margin expansion → Capital efficiency → Re-rating.

The Auto sector’s premiumisation story fits squarely into this wealth-creation arc.

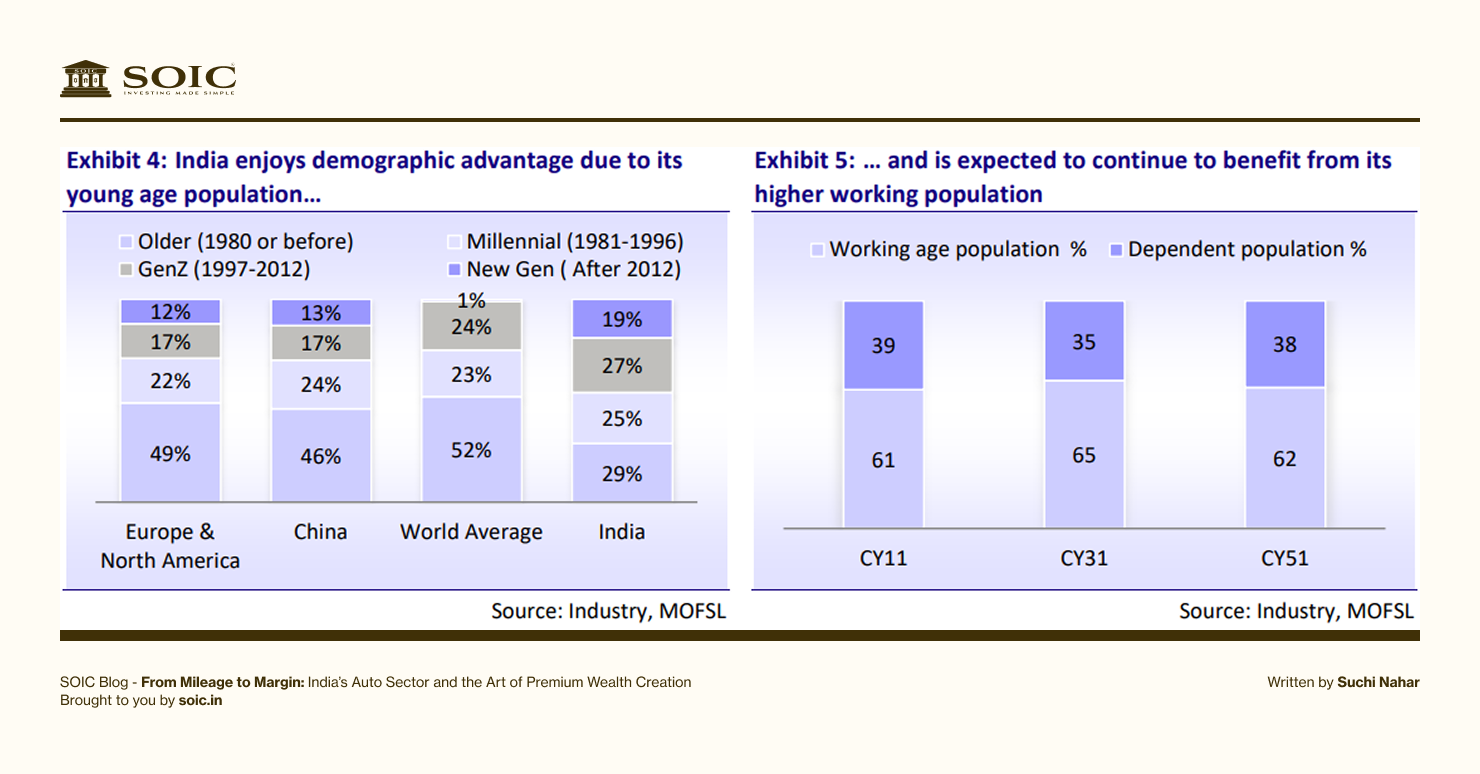

Historically, auto businesses were volume games – low-margin, high working capital, cyclical. India’s per capita GDP has crossed US$2,700 in 2024 and is ~US$2800in 2025, the same tipping point where China’s SUV and lifestyle consumption exploded between 2007–2011.

India’s consumption engine is moving from needs to wants, from mobility to lifestyle.

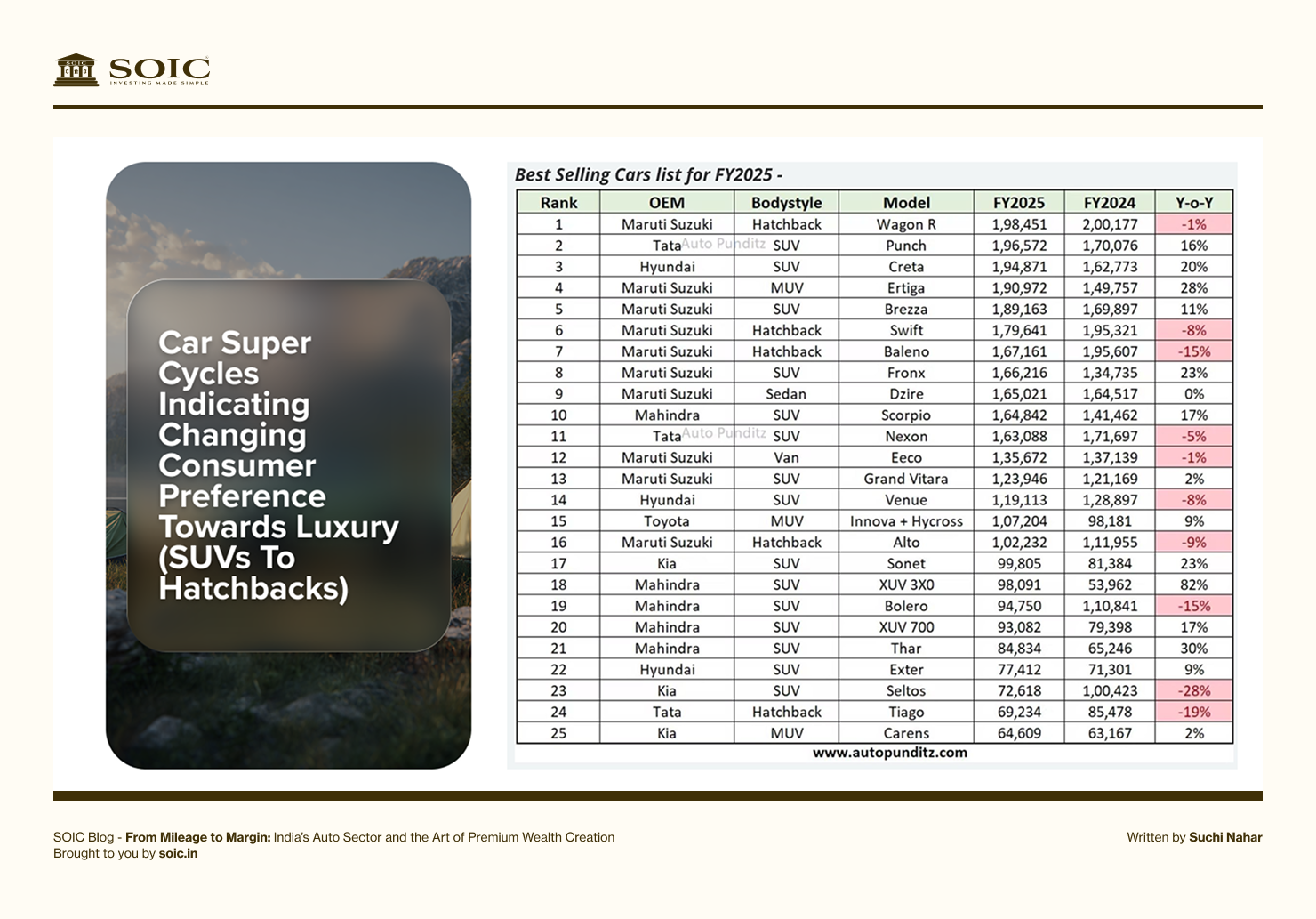

As seen in above data, most of the models that were best selling in the country in FY25 were SUVs and not Hatchbacks showing the shift in the consumer preference.

The consumer is no longer price-sensitive – they’re value-sensitive.

This change allows both OEMs and ancillaries to move up the value chain, earning higher margins from the same capacity base – the classic recipe for operating leverage + ROCE expansion = wealth creation.

Think of this like a “luxury goods flywheel” being re-created within Indian manufacturing:

Premiumisation, therefore, is not just a consumption trend – it’s a structural profit migration from mass to aspirational.

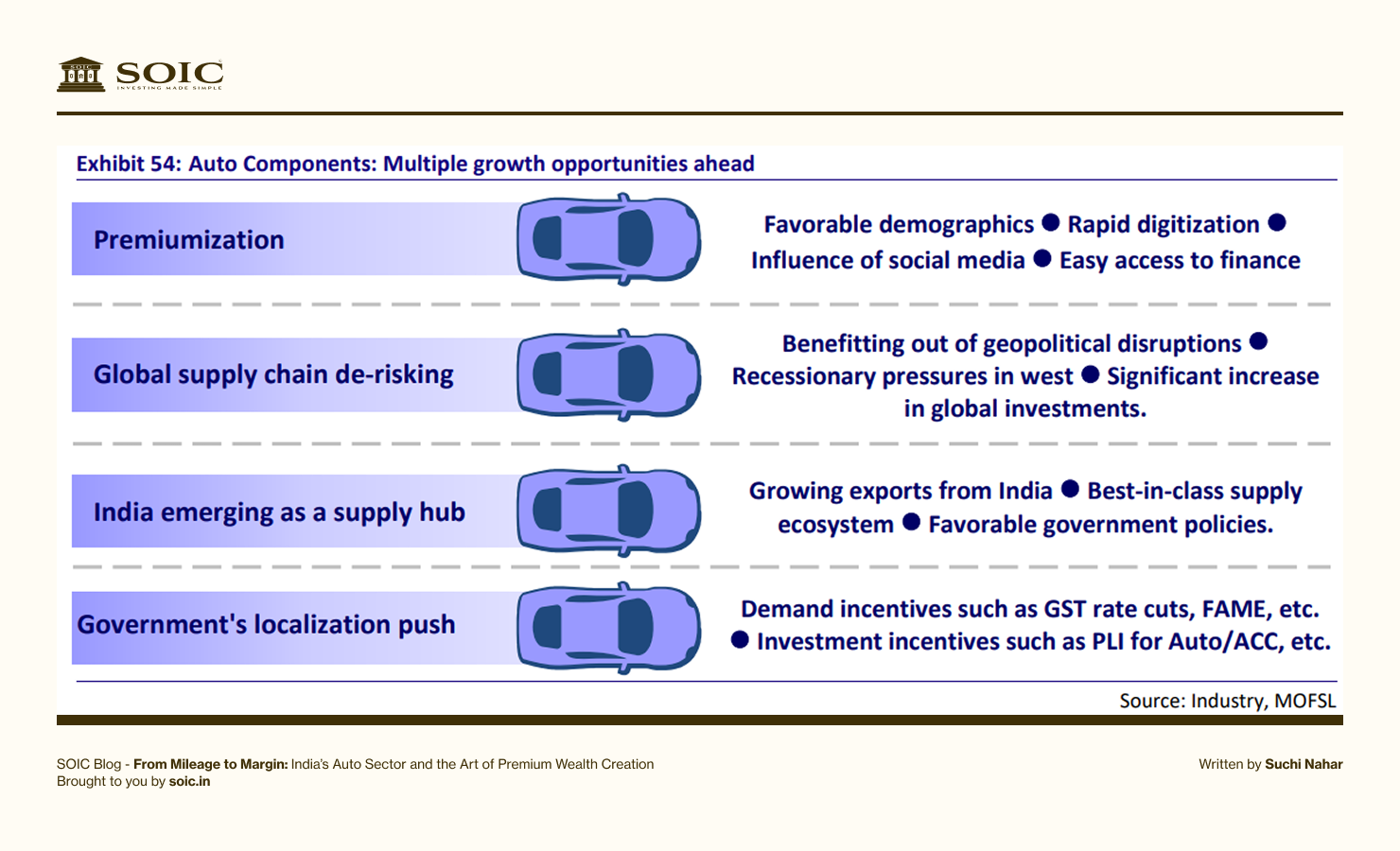

India’s “Make in India 2.0” narrative isn’t just about electronics or semiconductors - it’s auto-led manufacturing at its core.

Auto manufacturing contributes nearly 7% of India’s GDP and employs 3 crore+ people. But the next decade’s opportunity is qualitative growth, not just quantitative.

Why Auto leads the manufacturing renaissance:

In short - premiumisation isn’t consumption-led alone; it’s manufacturing-led wealth creation. India is learning to make not just cars – but better cars.

“India is graduating from small cars to upper-segment cars.” – R.C. Bhargava, Chairman, Maruti Suzuki

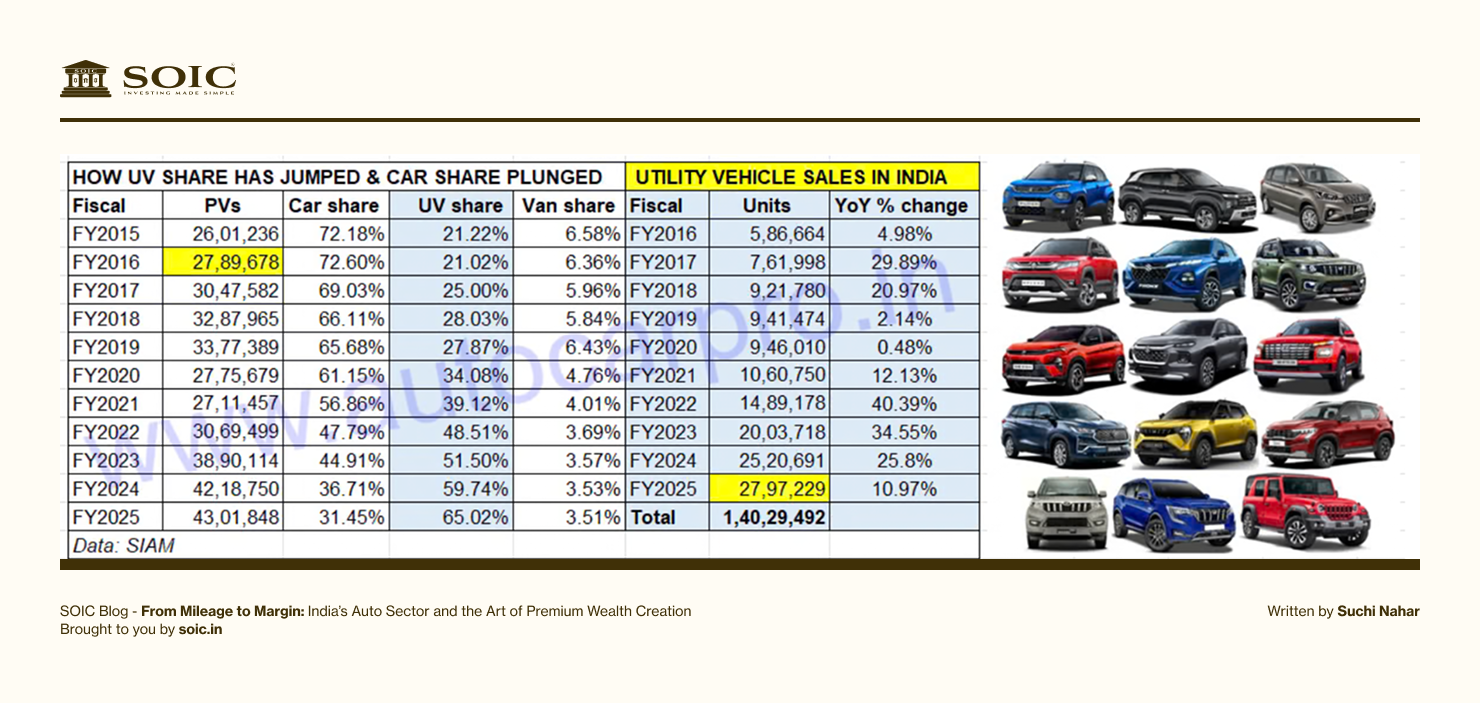

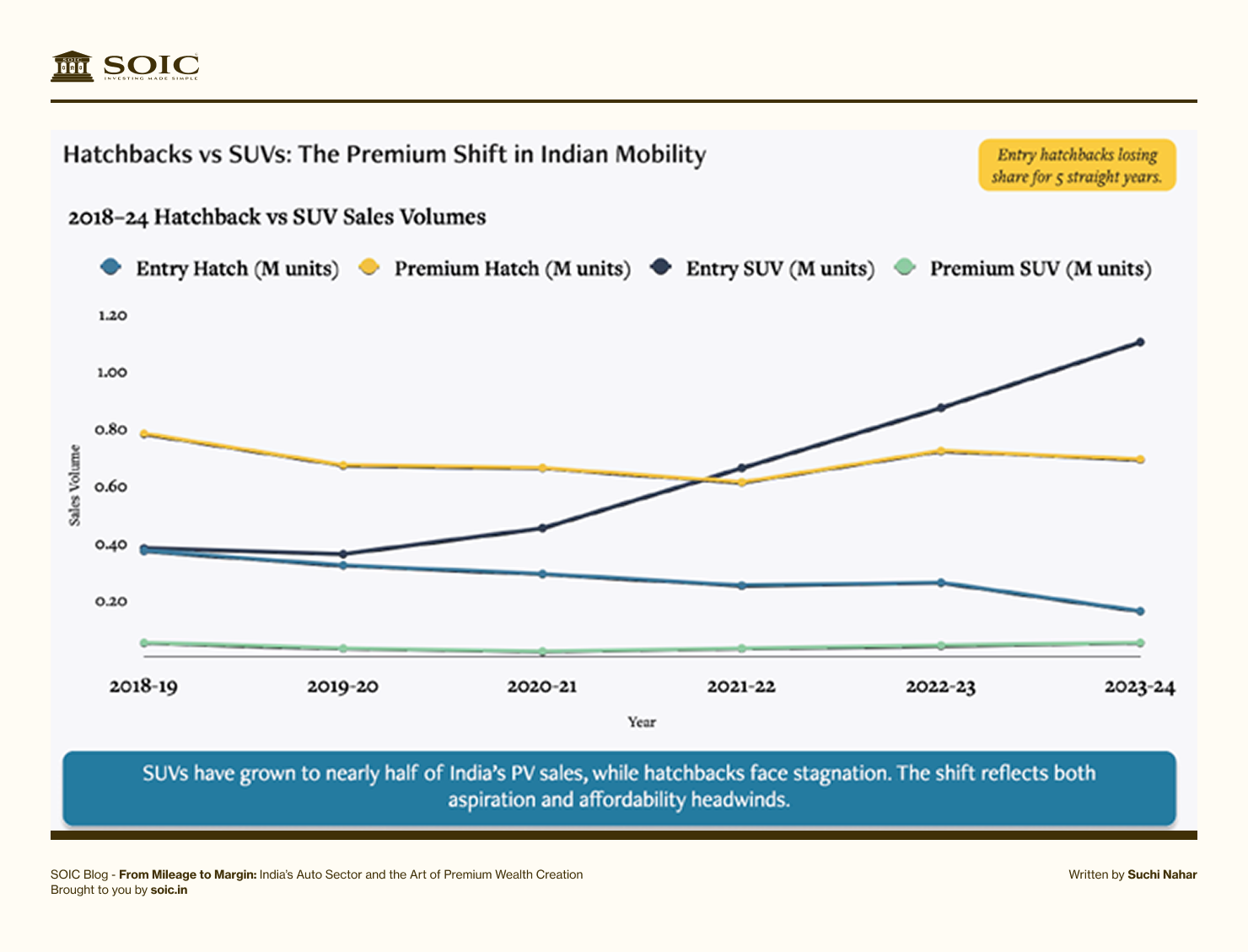

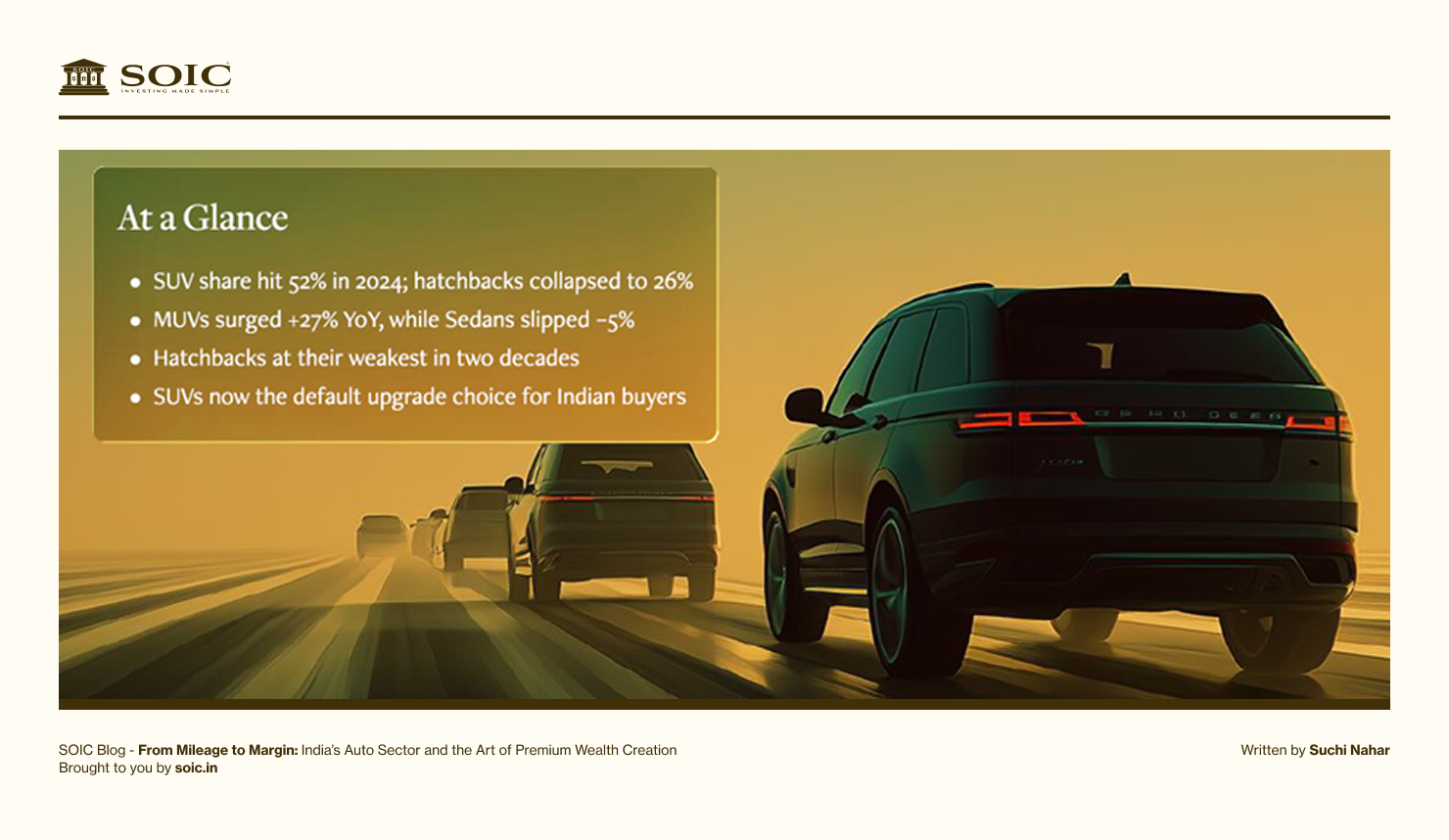

SUVs now make up 52% of passenger vehicle (PV) sales, up from just 26% in 2017.

Hatchbacks have fallen to their lowest share in two decades, while MUVs and crossovers surge.

This is not just demand reallocation – it’s aspiration reallocation.

Cars are no longer transportation; they’re identity. A Nexon or XUV700 is not “owned” – it’s projected.

OEMs have adapted fast. Maruti has re-entered the SUV game with Brezza and Grand Vitara. Tata’s portfolio (Nexon, Harrier, Curvv EV) now defines middle-class aspiration. Mahindra has become the SUV symbol in India.

Tata Motors’ EVs (Nexon EV, Punch EV) and MG’s ZS have found footing not through cost, but cool factor.

Indian EV adoption follows the global pattern - premium first, mass later.

This premium-first cycle creates new opportunities across ancillaries and design suppliers.

Premiumisation creates margin asymmetry.

For every ₹100 increase in ASP, ₹30–₹40 is pure incremental margin for suppliers with fixed-cost bases.

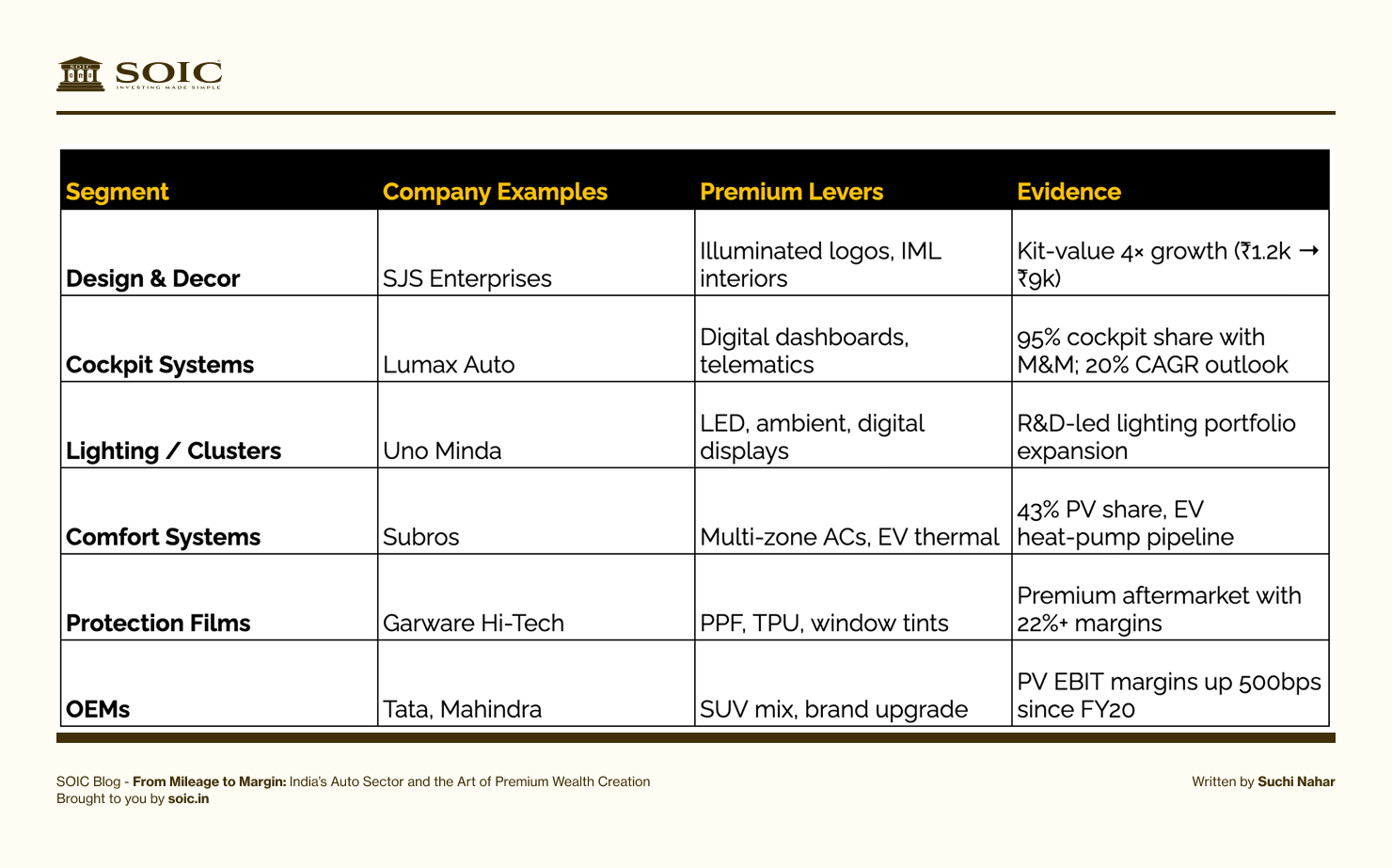

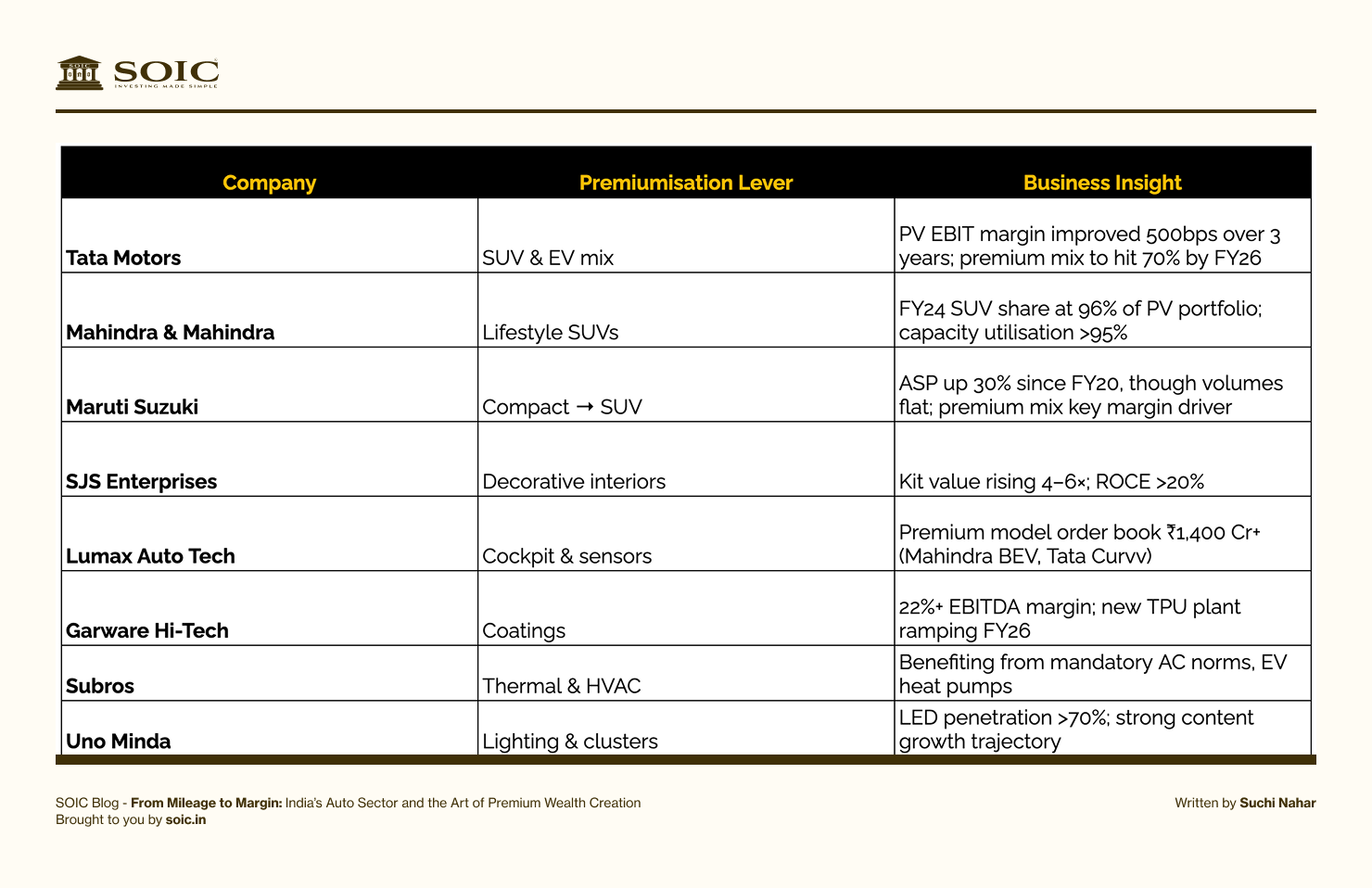

Let’s look at how different layers of the value chain capture this:

These firms don’t just “grow with auto volumes” - they compound with consumer aspirations.

As India trades up in cars, these companies trade up in margins.

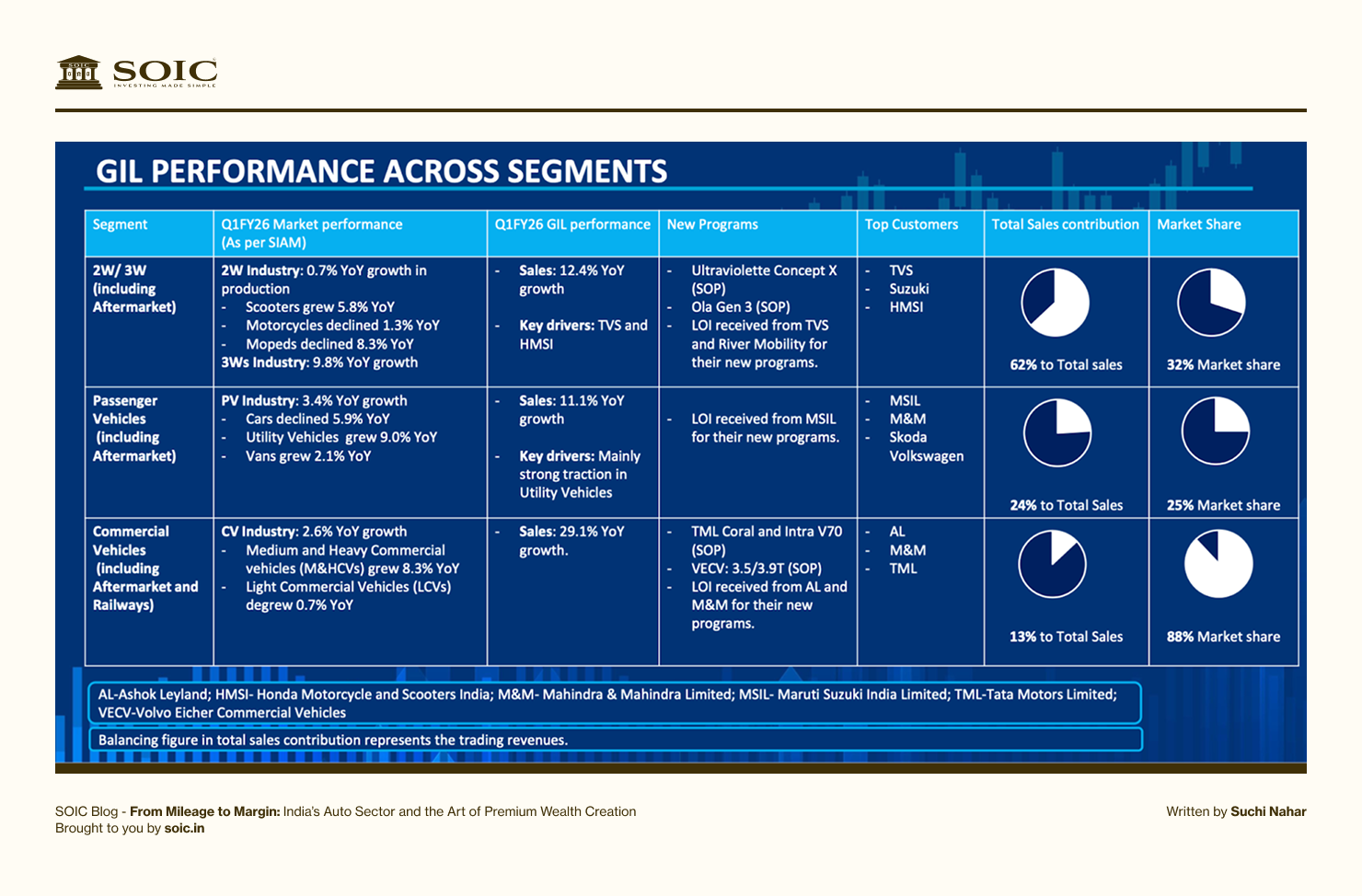

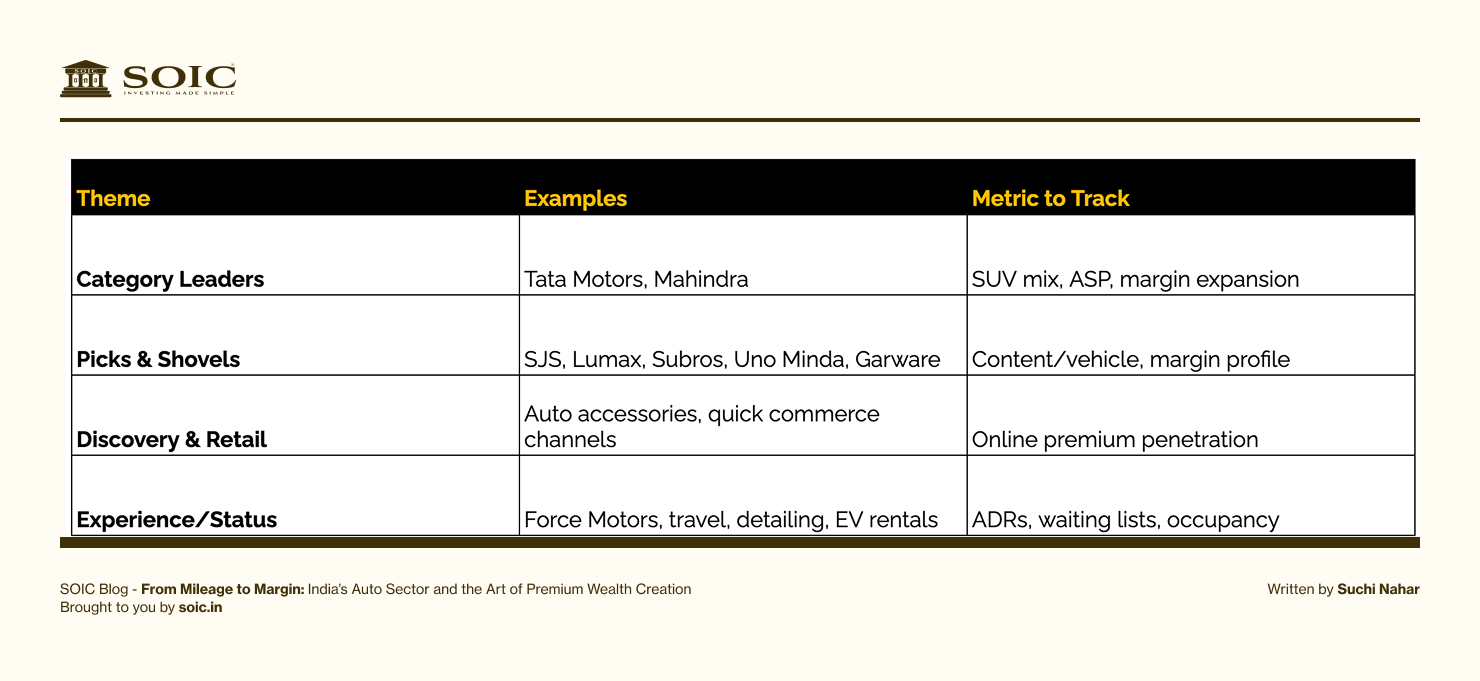

Understanding premiumisation by segment is key to portfolio positioning.

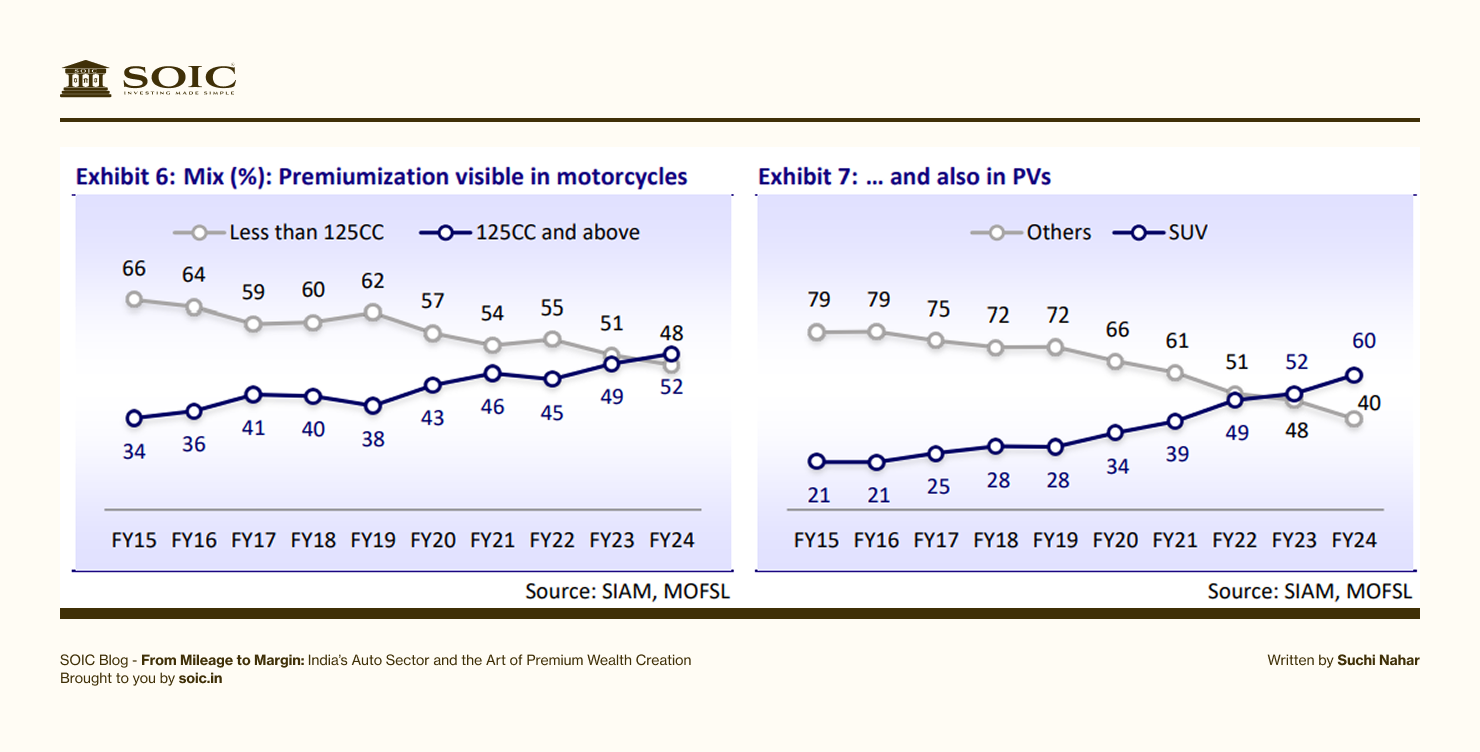

Two-Wheelers:

Premiumisation here is in the engine, not the metal.

Passenger Vehicles (PV):

This is the core of premiumisation.

Commercial Vehicles (CV):

Premiumisation = Safety + Comfort + Efficiency.

How to Choose:

Go where feature density and kit-value per vehicle rise fastest. That’s where pricing power and operating leverage meet.

Today, that’s PV/Two-wheeler + ancillary - the sweet spot of India’s auto premiumisation flywheel. One should be able to find the faster growing auto OEM and the proxy ancillary to that company. For example if Mahindra is currently the fastest growing PV OEM than one should be able to map out the the ancillaries to the trends playing out in Mahindra such as SJS supplying Decals and chrome plating to its newer XEV and BE6 models, Lumax Auto Tech into the cockpit for Mahindra, Lumax Industries supplying Lamp Lights and Ambient Lights, etc etc…

Mapping out the value chain always helps you find the most profitable and fastest growing part of the value chain.

Operating leverage is when fixed costs are already paid for, and every new rupee of sales adds disproportionately to profit. Flat 6–7% volume growth environment, operating leverage could drive 12–15% EPS growth for select ancillaries.

This happens when:

Operating leverage case studies:

When “value per unit” rises faster than “volume per unit,” the business hits a margin flywheel.

This is where wealth creation silently accelerates.

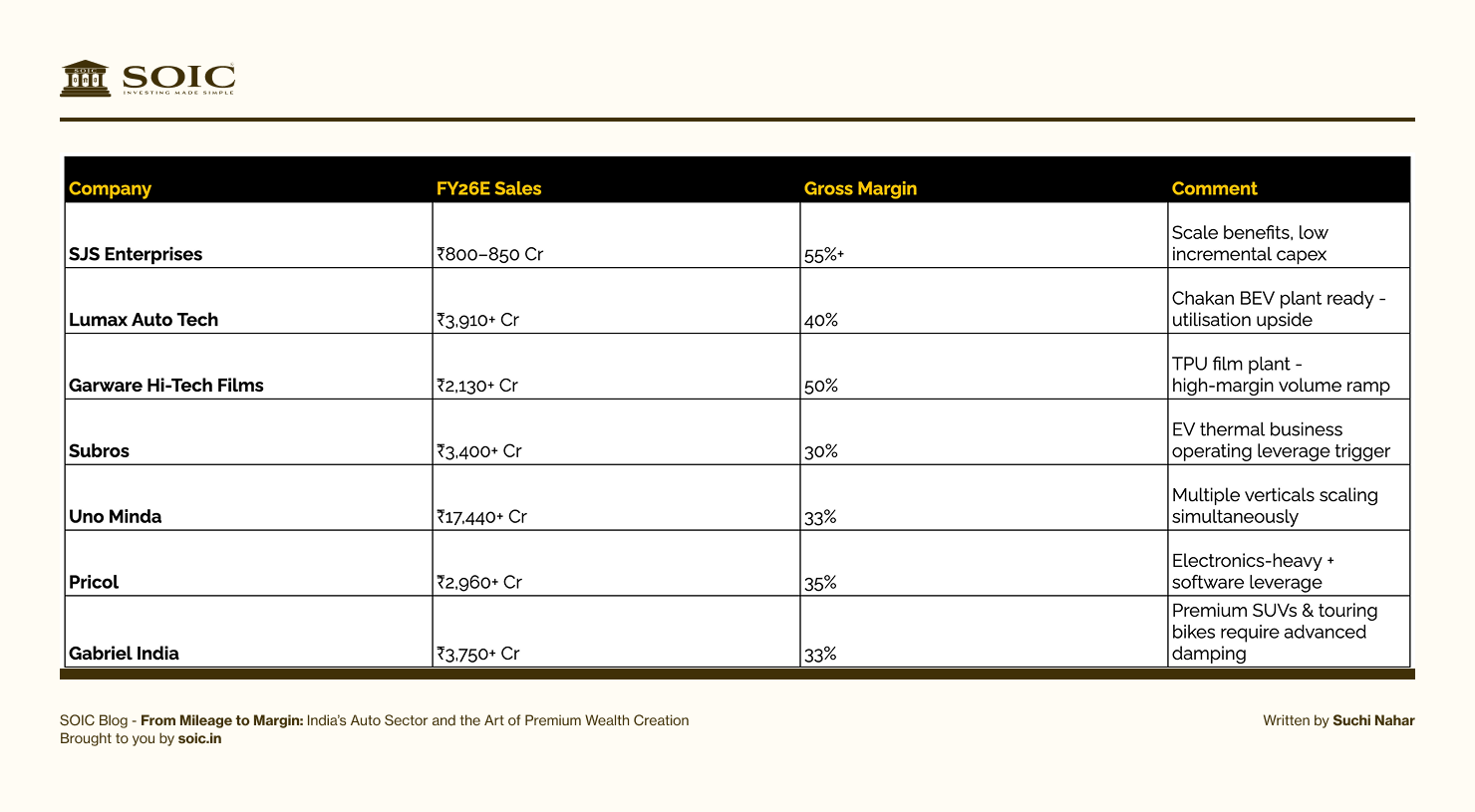

Let’s map who sits where:

These companies have already built the factories, tools, and teams.

Now, as premium trims grow, their incremental EBITDA flow-through is far higher than revenue growth.

A 10% topline rise can lead to 20–30% bottom-line growth in these businesses - the hallmark of compounding through operating leverage.

Every layer of the vehicle - from chrome trims to connected dashboards - is monetising premium aspiration.

Let’s explore how India’s auto ecosystem is upgrading under the hood.

Mahindra & Mahindra – The SUV Evangelist

Mahindra’s turnaround story is one of India’s most fascinating case studies.

They exited small cars entirely and doubled down on SUVs – Scorpio N, XUV700, Thar – each with strong aspirational pull.

Highlights:

Why it wins:

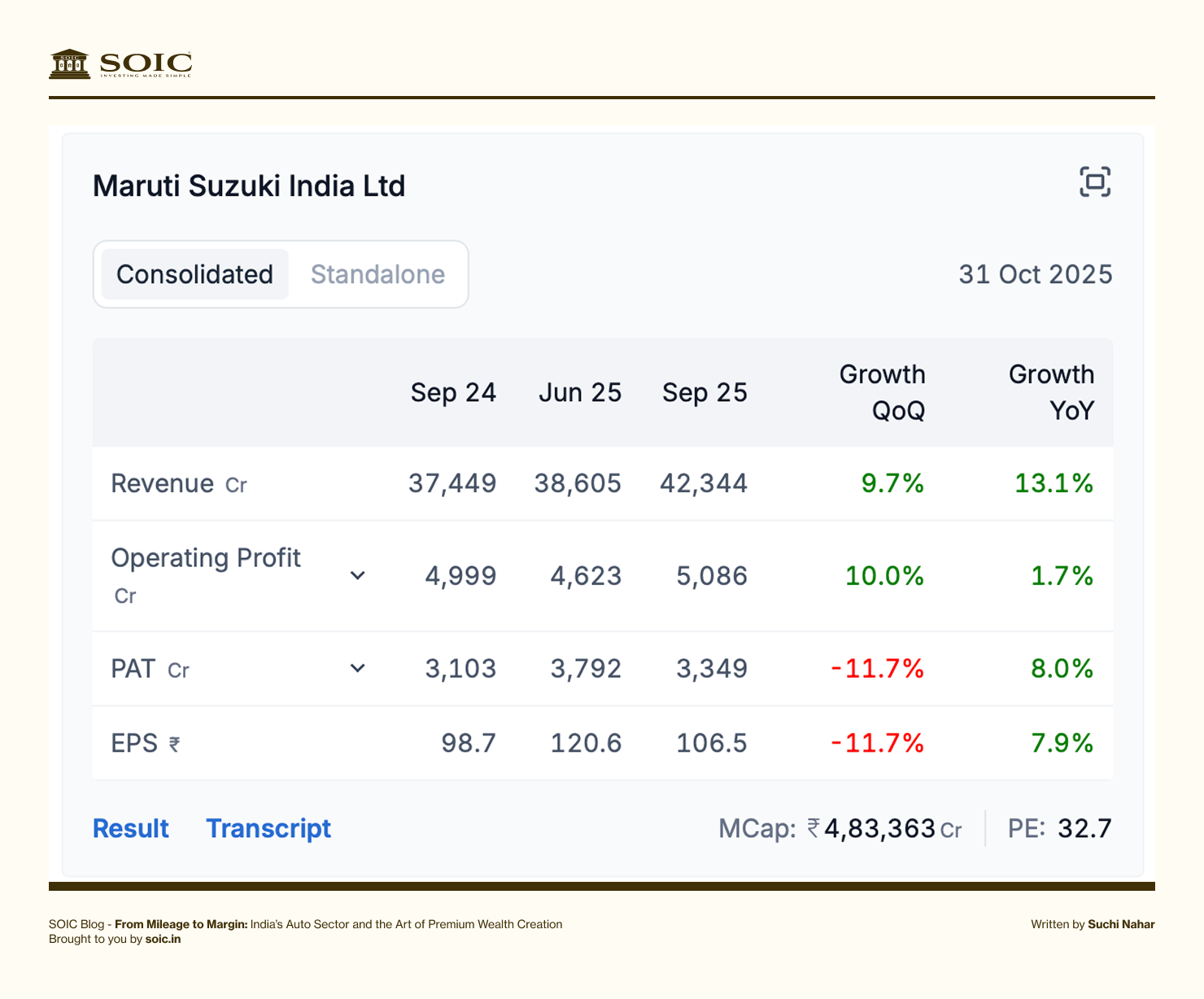

Once synonymous with affordable mobility, Maruti faces a structural challenge, how to remain India’s #1 when India no longer wants cheap cars.

Their recent launches (Grand Vitara, Jimny, Fronx) are early attempts at reclaiming relevance among premium buyers.

Challenges:

Maruti’s premiumisation journey is about survival - not strategy.

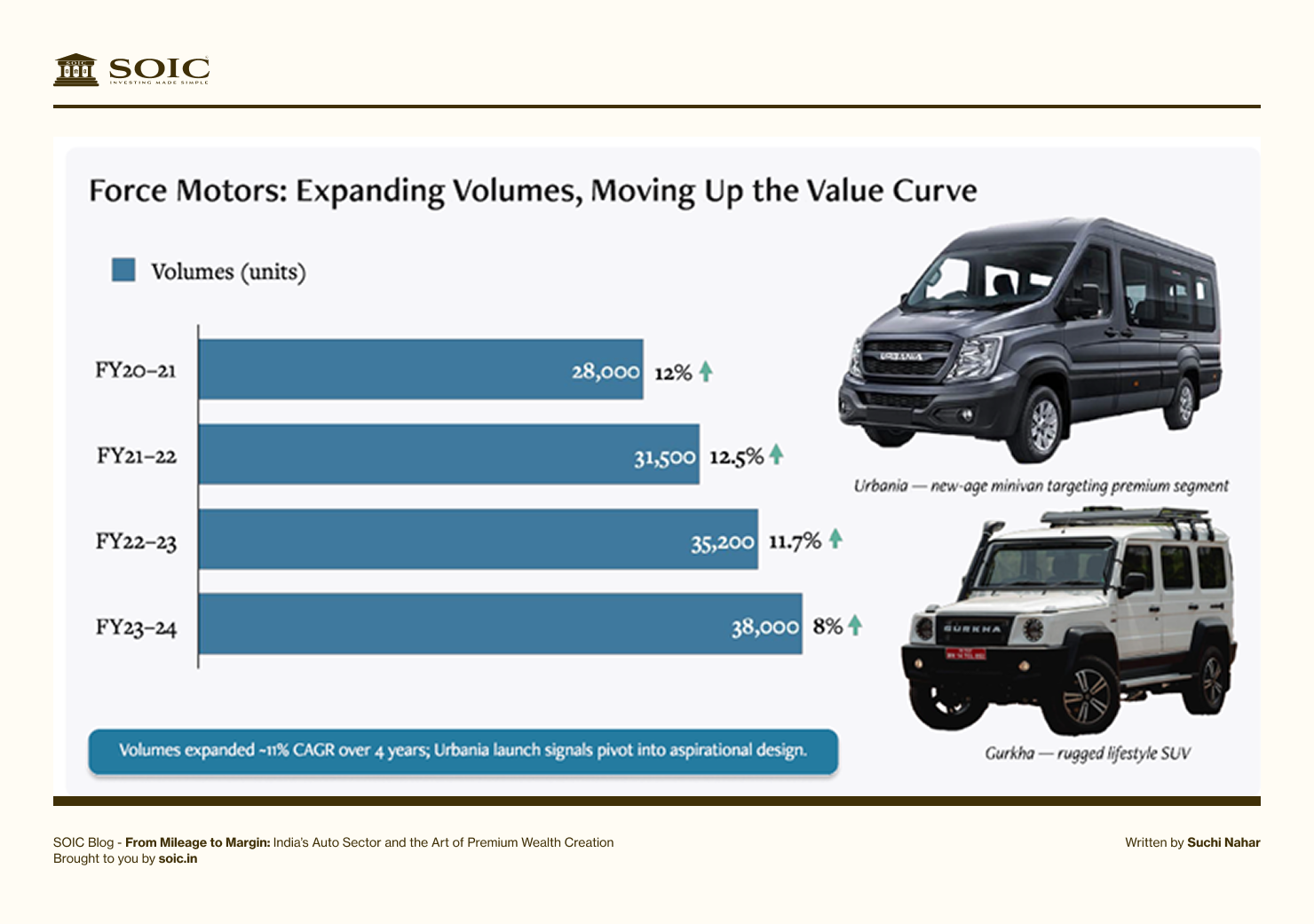

Force Motors, known for its commercial fleet, is quietly reinventing itself for aspirational mobility.

Models like Urbania (premium minivan) and Gurkha (off-road SUV) signal its premium pivot.

FY25 Highlights:

Force’s niche may be small, but its positioning mirrors India’s broader consumption ladder, from people carrier to premium comfort.

Tata’s PV market share has nearly tripled since FY20, led by Nexon, Harrier, and Safari.

They’ve successfully created mass-premium brands at accessible price points.

The upcoming Curvv EV and Avinya line mark Tata’s push into futuristic design-led mobility.

Why it wins:

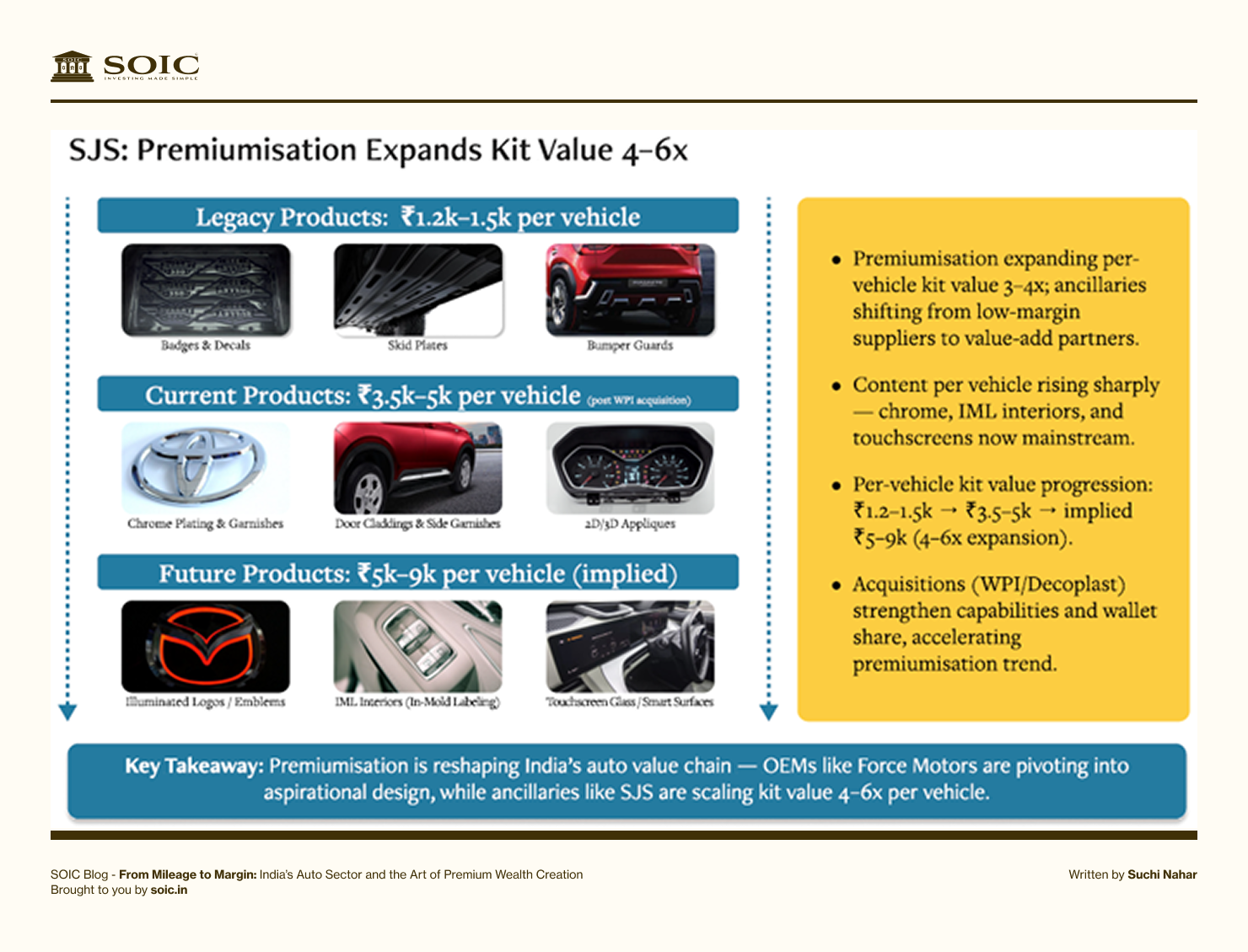

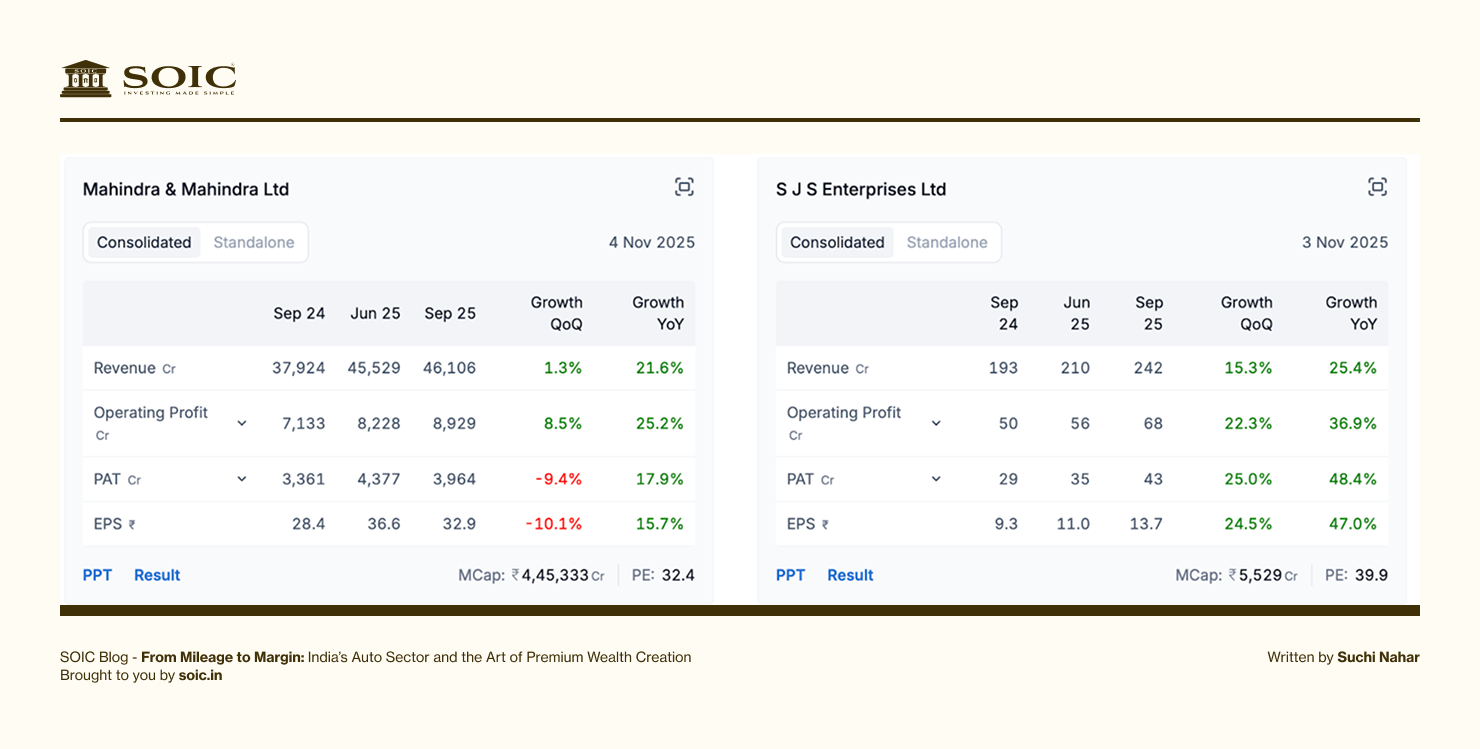

SJS has become the poster child of premiumisation in Indian ancillaries.

From decals and badges to illuminated logos, 3D appliques, and IML interiors, SJS has quadrupled its kit value per vehicle:

₹1,200 → ₹3,500 → ₹9,000 over the next cycle.

Their acquisition of Walter Pack India (WPI) expanded capabilities in 3D surface, glass overlays, and luxury interior trims.

FY26 Outlook:

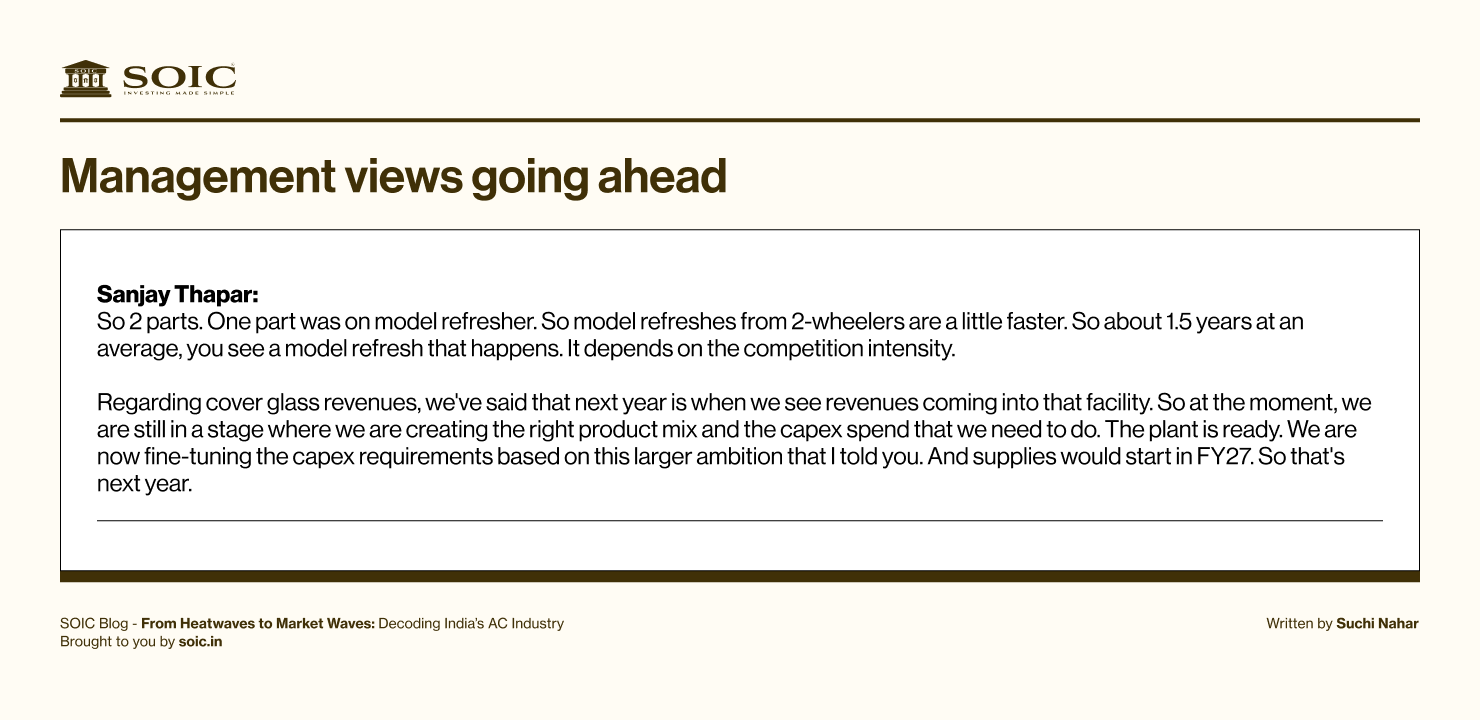

Management views going ahead:

SJS is transforming from a supplier to a brand enabler - one that adds perception, not just parts.

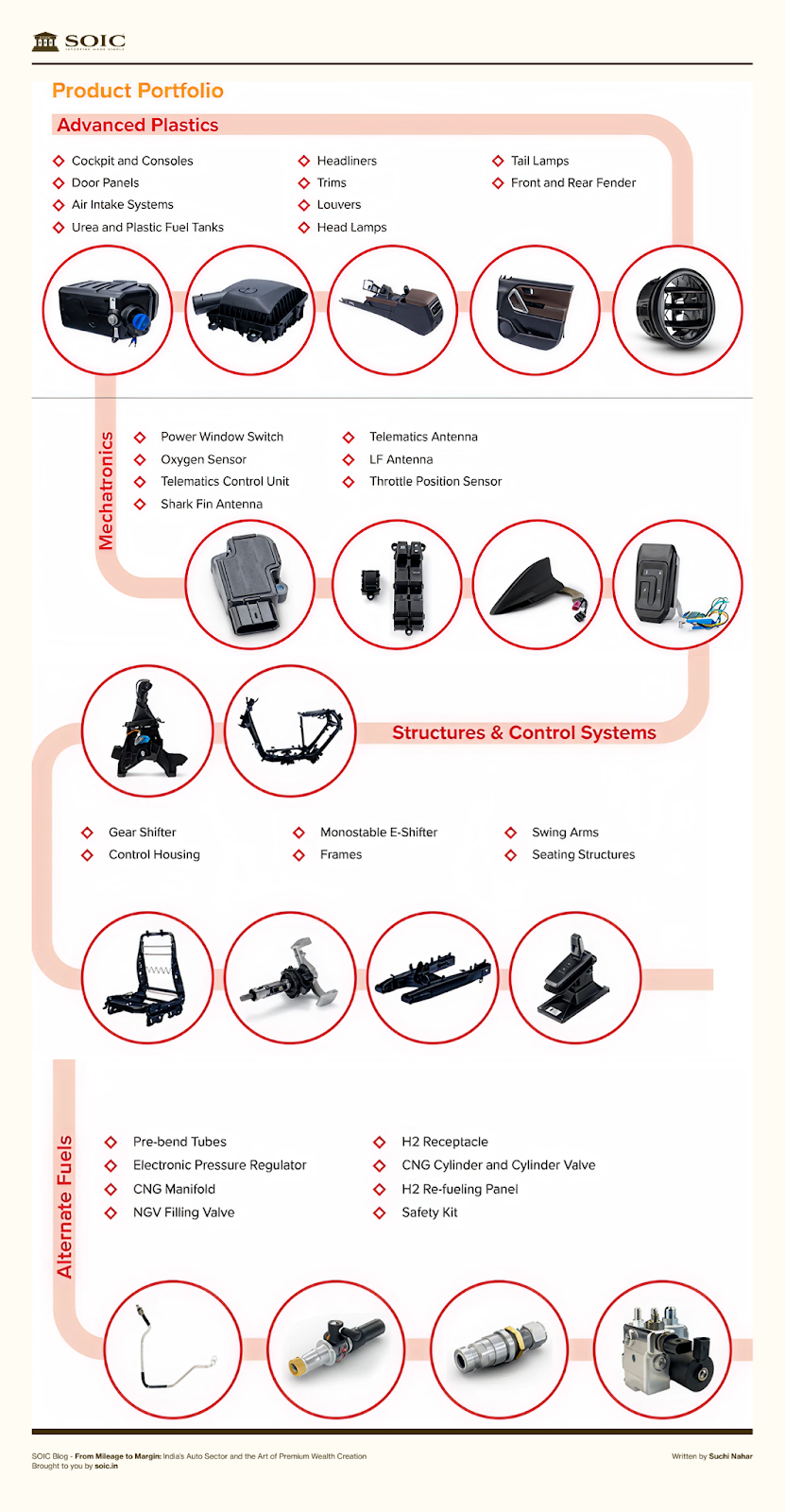

Lumax’s pivot is bold, from plastic assemblies to full cockpit systems and telematics.

Their integration with global tech partners (Alps, Yokowo, FAE, Ituran, Jopp) and the SHIFT R&D centre gives them an edge in software-defined vehicles (SDVs).

Management View:

Key Insights:

Lumax isn’t just supplying parts; it’s building the brain and interface of India’s premium cars.

What Apple did for phone cases, Garware is doing for car protection.

Their paint protection films (PPF) - once niche - are now standard among premium buyers.

Highlights:

Garware’s shift from commodity films to premium coatings shows how aesthetic utility is monetising aspiration.

As cars premiumise, comfort becomes non-negotiable.

Subros, with ~43% share in car HVAC systems, is at the heart of this shift.

Premium trims mean:

Tailwinds:

For Subros, premiumisation means higher content per car, higher aftermarket attach, and an expanding R&D moat.

Lighting is an emotional design, the first thing you notice about a premium car.

Uno Minda’s lighting systems, digital clusters, and connected cockpits are scaling rapidly.

Insights:

For every SUV that upgrades its DRL signature or ambient glow – Uno Minda captures that margin.

Management views going ahead:

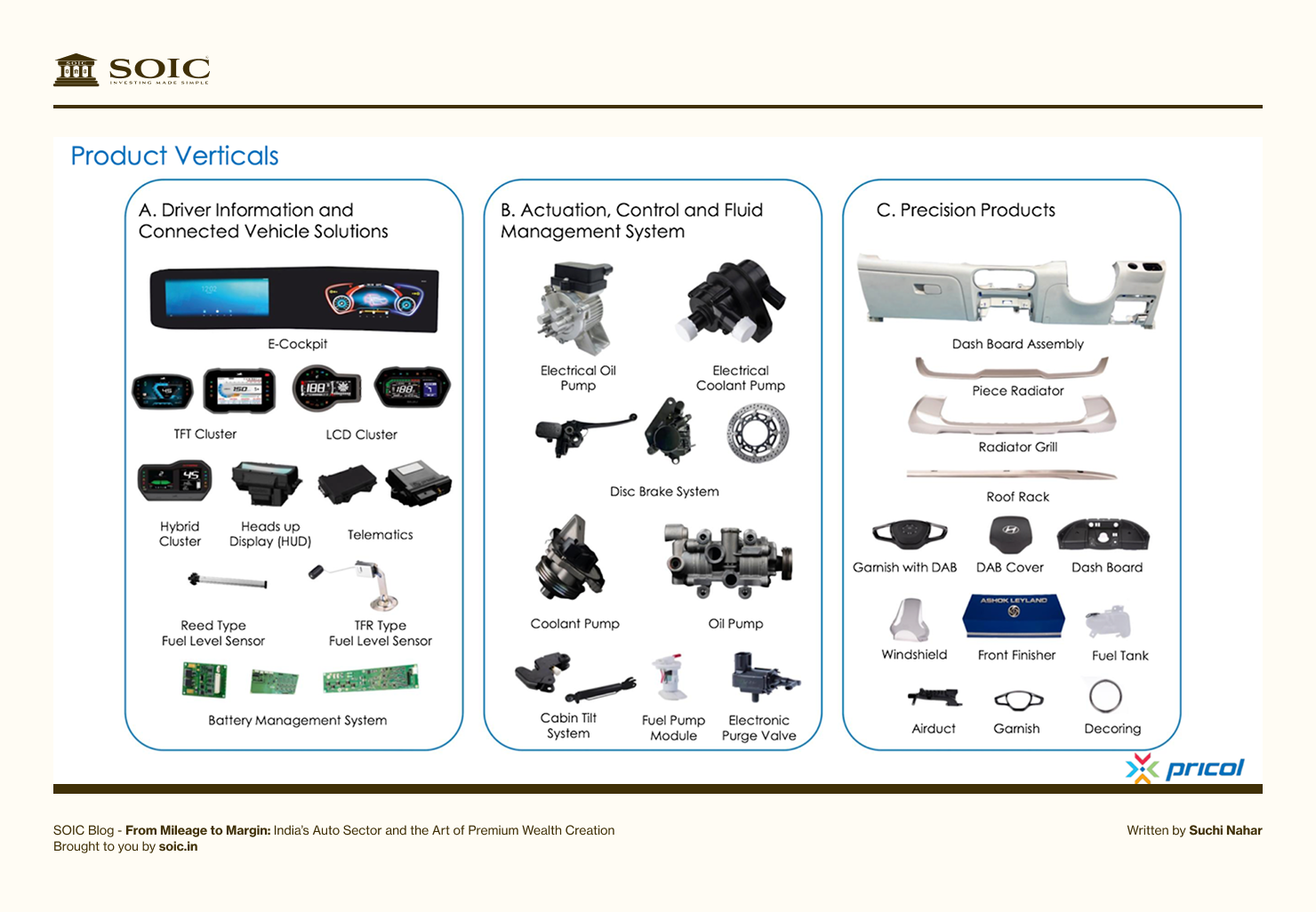

Pricol has established itself over the past four decades as a leading global brand in automotive instruments and products. The company provides instrument clusters that are customer-centric, rich in features, and user-friendly interfaces, making them essential for both OEMs and consumers.

This sector is currently undergoing a transformation driven by digitisation and premiumisation, with digital and TFT clusters set to replace traditional mechanical ones in the near future. As the dominant player in the domestic market (holding 50% share in 2-wheelers, 70% in Commercial Vehicles, and 90% in off-highway segments), Pricol is strategically positioned to capitalize on this projected growth.

It is entering into the highly profitable e-cockpit and heads-up display business. Its eight domestic manufacturing plants cover all major auto clusters and one plant in Indonesia. Led by a strong management team and robust corporate governance, it can successfully turnaround the recently acquired Sundaram Auto Components.

Premiumisation has continued, especially in the EVs, as upcoming models pivot towards TFT clusters over digital ones. The market share of TFT clusters is expected to rise from 8–10% at present to ~30% in mid term as mechanical clusters are replaced with new Digital and TFT clusters in new models. This will lead to higher ASP of ~8-9% as content per vehicle (CPV) for a LCD/digital and TFT cluster is 3– 4x/10–15x greater than a mechanical one. PRICOL, being the domestic leader in the instrument cluster business, is best placed to capture the premiumisation trend

In December 2024, PRICOL acquired Sundaram Auto Components' (SACL) plastic injection module business for 3.2x EV/EBITDA. The EPS-accretive acquisition will be named Pricol Precision. Despite SACL's historical underperformance, a turnaround is expected as it is no longer restricted from selling to other 2W players after leaving the TVS group.

Overall, we believe in the company's mid to long term vision and forecast sales/ EBITDA/PAT CAGR of 27–28% over FY25–27, driven by: i) greater premiumization, ii) turnaround of SACL business, and iii) product launches.

Gabriel India, the only listed firm of USD 1.9bn Anand Group, with a ~31% market share in India’s 2W suspension segment market (61% of total sales) as on FY24, is likely to benefit from the 2W industry recovery as well as rising premiumisation trend. It has a first-mover advantage in e2W with a 70% share as on Q4FY24 as per the company.

From a single-product firm specializing in suspension systems, the company is transitioning into a multi-product company by foraying into sunroofs, given rising premiumization trends. The current sunroof penetration at 25% of the PV market is set to increase to 40% by FY27E.

GABRIEL has a joint venture with Netherlands-based Inalfa Roof Systems Group, the second-largest sunroof manufacturer globally. The sunroof plant at Chennai commenced operations in January 2024 with a current capacity of 200,000 units pa and aiming to double current capacity to 400,000 units pa by FY26. Also, its diversification strategy includes: 1) new products should be powertrain-agnostic, 2) new offerings should not compete with existing Anand Group products, and 3) acquisition should not be a distressed asset.

Thus, this transition to a multi-product company will be a catalyst for rerating, in our view. GABRIEL PV market share rose to ~23% in FY24 from 15% in FY20, led by SUV penetration, with industry volume increasing to 60% from ~35% and new order wins from key clients. Further, it commands a higher share of ~35% in SUV vs 23% in PV, bolstering market share, as SUV are likely to continue to outgrow the industry.

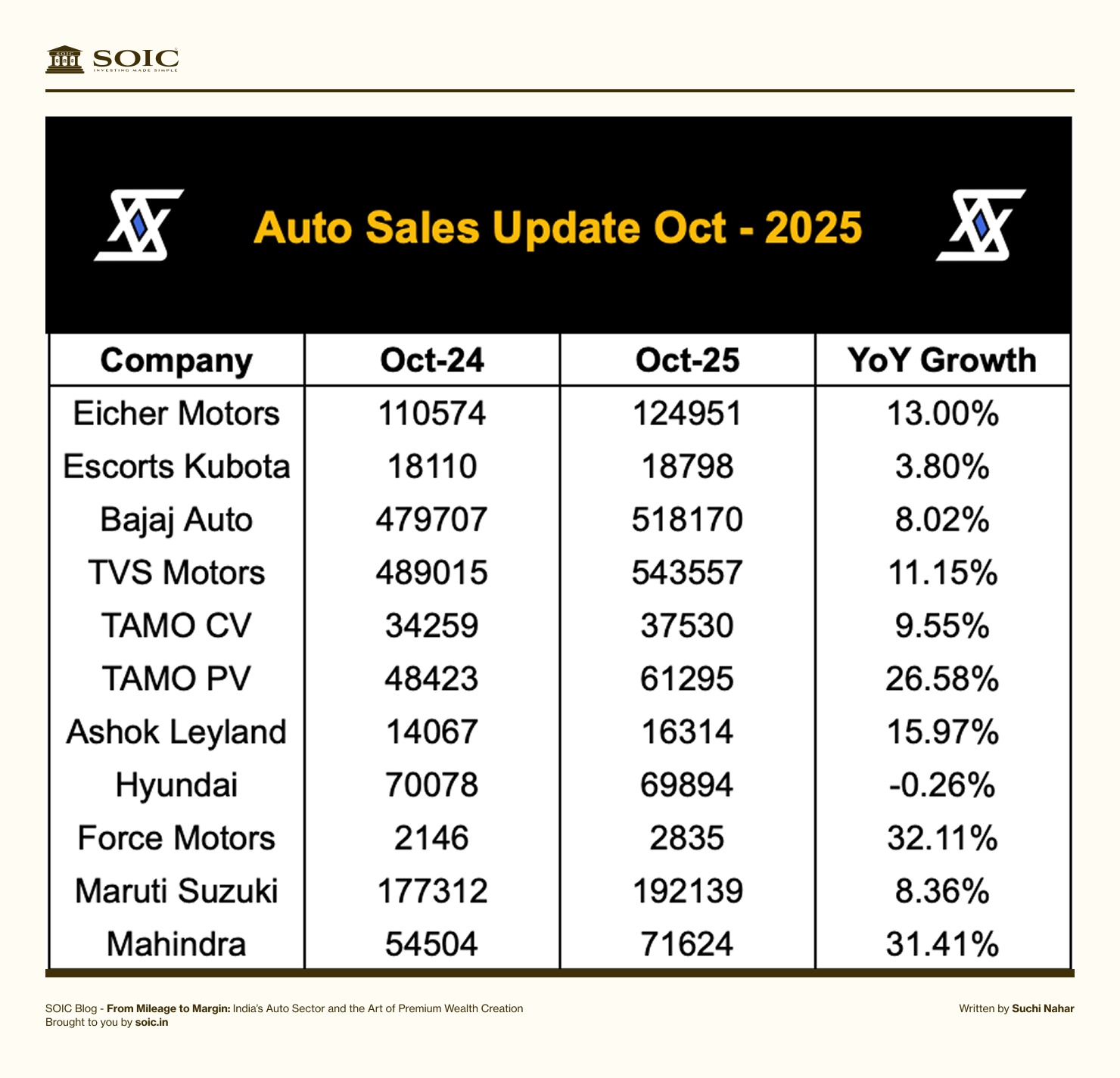

The Demand across this OEMs has also seen uptick in October month led by the GST cuts and Diwali season

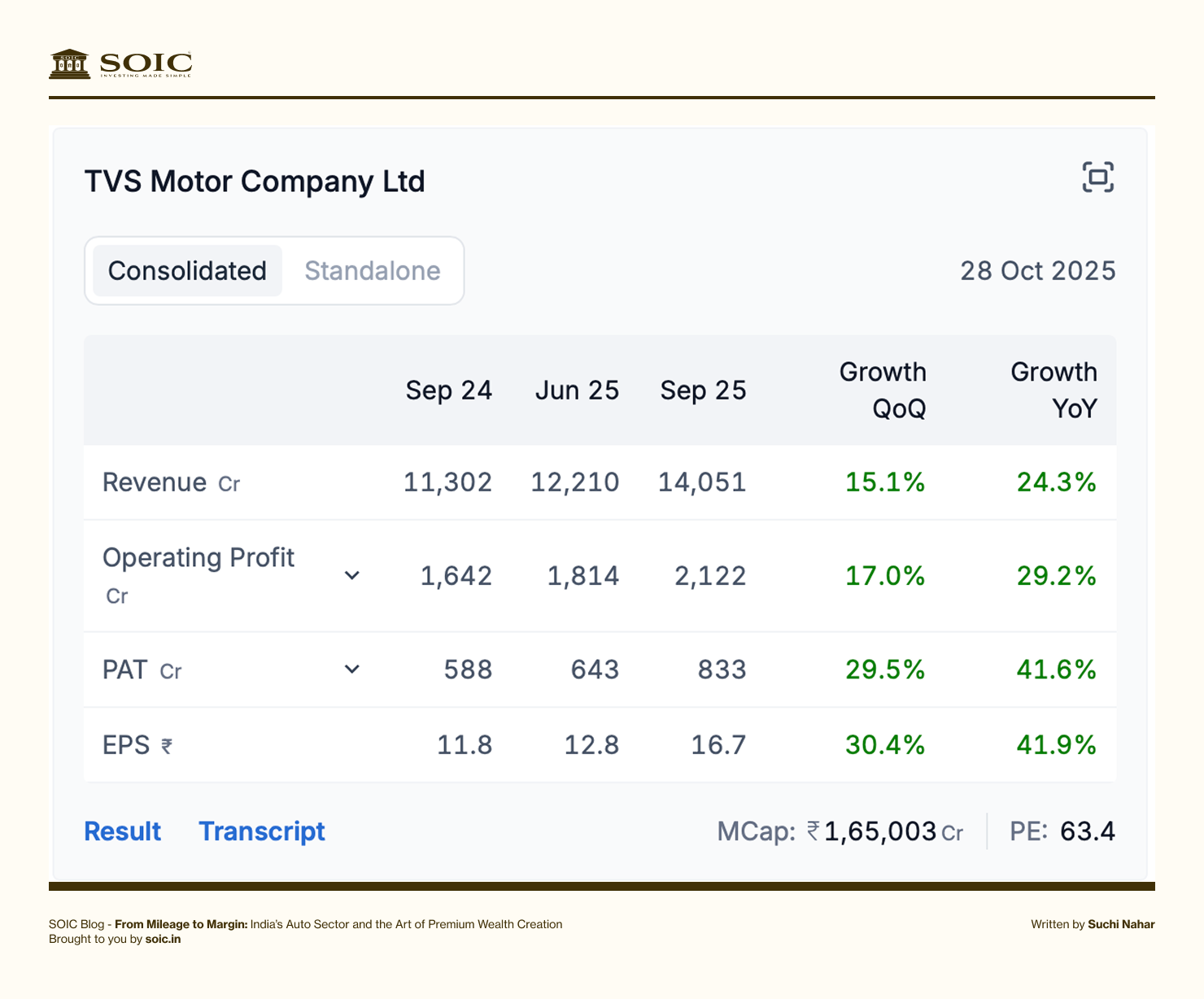

Amongst PVs companies like Mahindra and Force Motors who have higher mix of UVs in their product portfolio showing the shift in the incremental consumer preference. Also TVS Motors and Eicher Motors stand out amongst the 2 wheelers showing better growth than its peers

Source: StockScans

Even the trend was visible in the Q2 performance of this Auto OEMs and their proxies where Mahindra again was a clear outperformer and SJS has also posted super strong performance in their Q2Fy26 results outperforming the Indian automotive industry by 3x margin. This shows how the trends are shifting towards premiumisation in auto industry

Premium portfolios deliver 300–500 bps higher EBITDA margins than mass-market offerings.

But more importantly, they build brand resilience – buyers of premium trims don’t easily downshift during slowdowns.

For ancillaries like SJS, Subros, and Lumax - content per vehicle increases 3–6×.

For OEMs – ASP growth outpaces volume, providing leverage even in flat demand environments.

Example:

This is the economics of desire - where better design = better profit.

India’s smaller cities are driving the upgrade cycle faster than metros.

Social media exposure, influencer culture, and better roads have made SUVs and premium two-wheelers aspirational even in towns like Raipur, Kochi, and Vadodara.

OEMs are localising showrooms, financing, and service centres to capture this wave.

Premium is no longer elitist – it’s distributed aspiration.

India’s mobility is no longer about moving people – it’s about moving perceptions.

The middle-class dream has upgraded from owning a car to owning an experience.

From SJS’s illuminated logos to Lumax’s connected cockpits, from Garware’s glossy films to Mahindra’s BE EVs – India’s automotive ecosystem is driving up the value chain.

The next decade will be about how well companies sell the upgrade. Because in modern India, the drive itself has become the destination.

We often think of premiumisation as an outcome – better products, higher prices. But for investors, the real premium lies in identifying the process behind that outcome – the mix improvement, cost absorption, and technological leap that silently rerates a company.

India’s auto ecosystem is entering that zone – where design, comfort, and emotion intersect with manufacturing capability.

As OEMs chase aspiration, ancillaries harvest margin.

The next multi-baggers may not make the cars you see on the road – but the logos, cockpits, lighting, or films that make those cars desirable. Because in this premiumisation cycle – Wealth won’t come from chasing volume. It will come from owning value.

Share your thoughts below!

Disclaimer:

The information provided is for educational purposes only and should not be considered investment advice. As an educational organisation, our objective is to provide general knowledge and understanding of investment concepts. We are SEBI-registered research analysts.

It is recommended that you conduct your own research and analysis before making any investment decisions. We believe that investment decisions should be based on personal conviction and not borrowed from external sources. Therefore, we do not assume any liability or responsibility for any investment decisions made based on the information provided in this reference.

0 Comments